Authors

Summary

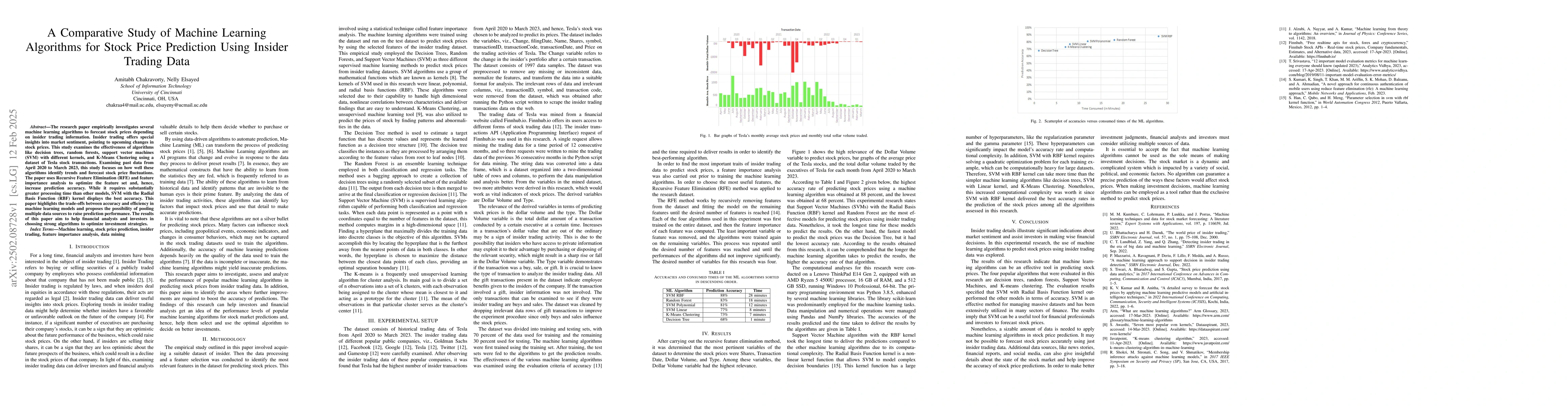

The research paper empirically investigates several machine learning algorithms to forecast stock prices depending on insider trading information. Insider trading offers special insights into market sentiment, pointing to upcoming changes in stock prices. This study examines the effectiveness of algorithms like decision trees, random forests, support vector machines (SVM) with different kernels, and K-Means Clustering using a dataset of Tesla stock transactions. Examining past data from April 2020 to March 2023, this study focuses on how well these algorithms identify trends and forecast stock price fluctuations. The paper uses Recursive Feature Elimination (RFE) and feature importance analysis to optimize the feature set and, hence, increase prediction accuracy. While it requires substantially greater processing time than other models, SVM with the Radial Basis Function (RBF) kernel displays the best accuracy. This paper highlights the trade-offs between accuracy and efficiency in machine learning models and proposes the possibility of pooling multiple data sources to raise prediction performance. The results of this paper aim to help financial analysts and investors in choosing strong algorithms to optimize investment strategies.

AI Key Findings

Generated Jun 11, 2025

Methodology

This study employs decision trees, random forests, support vector machines (SVM) with linear, polynomial, and radial basis function (RBF) kernels, and K-Means clustering to predict stock prices using insider trading data from Tesla from April 2020 to March 2023. Feature importance analysis and Recursive Feature Elimination (RFE) are used to optimize the feature set.

Key Results

- SVM with RBF kernel achieved the highest prediction accuracy of 88%.

- Random Forest also performed well with 83% accuracy.

- Decision Tree, though the fastest, had the lowest accuracy of 68%.

- The study found that Dollar Volume and Type are the most relevant variables for predicting stock prices.

- Longer processing times generally correlate with higher prediction accuracy across the algorithms tested.

Significance

This research demonstrates the effectiveness of machine learning algorithms in stock price prediction using insider trading data, providing insights that can assist financial analysts and investors in optimizing investment strategies.

Technical Contribution

The research highlights the trade-offs between accuracy and efficiency in machine learning models for stock price prediction, emphasizing the superior performance of SVM with RBF kernel in terms of accuracy despite higher computational demands.

Novelty

This work contributes to the field by specifically analyzing the effectiveness of various machine learning algorithms on insider trading data for stock price prediction, identifying SVM with RBF kernel as the most accurate model while also discussing the computational trade-offs.

Limitations

- The study is limited to Tesla stock data, which may not be generalizable to all stocks or markets.

- Reliance on historical data may not account for unforeseen future events impacting stock prices.

Future Work

- Investigate the predictive power of these algorithms on a broader range of stocks and markets.

- Explore the integration of additional data sources like news, financial reports, and social media for enhanced prediction accuracy.

Paper Details

PDF Preview

Similar Papers

Found 4 papersComparative Study of Machine Learning Models for Stock Price Prediction

Ogulcan E. Orsel, Sasha S. Yamada

A machine learning approach to support decision in insider trading detection

Fabrizio Lillo, Piero Mazzarisi, Adele Ravagnani et al.

Short-Term Stock Price-Trend Prediction Using Meta-Learning

Shin-Hung Chang, Cheng-Wen Hsu, Hsing-Ying Li et al.

No citations found for this paper.

Comments (0)