Summary

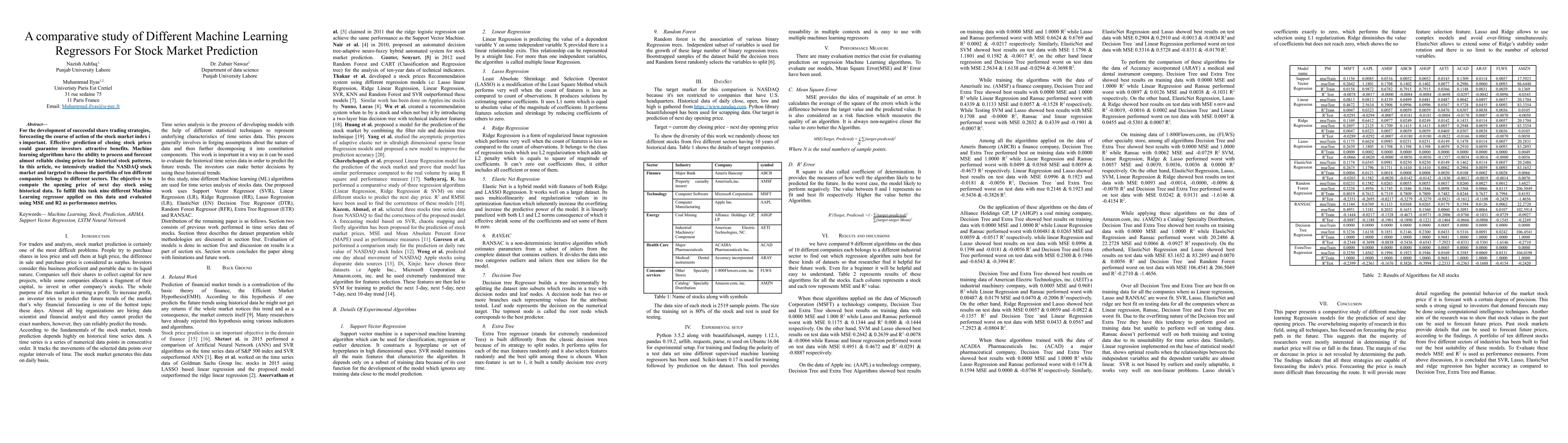

For the development of successful share trading strategies, forecasting the course of action of the stock market index is important. Effective prediction of closing stock prices could guarantee investors attractive benefits. Machine learning algorithms have the ability to process and forecast almost reliable closing prices for historical stock patterns. In this article, we intensively studied NASDAQ stock market and targeted to choose the portfolio of ten different companies belongs to different sectors. The objective is to compute opening price of next day stock using historical data. To fulfill this task nine different Machine Learning regressor applied on this data and evaluated using MSE and R2 as performance metric.

AI Key Findings

Generated Sep 05, 2025

Methodology

A comparison of different machine learning regression models was conducted to predict next-day opening prices.

Key Results

- SVR, Lasso, Elastic Net, and Ridge regression had higher accuracy compared to Decision Tree, Extra Tree, and RANSAC.

- The majority of research in this field has focused on forecasting the price path in the future.

- Forecasting the price is much more difficult than forecasting the route.

Significance

This research shows that demand for forecast models may be high among investors who want to predict market prices with a certain degree of precision.

Technical Contribution

The study contributes to the development of new machine learning regression models for stock price prediction.

Novelty

This research highlights the importance of forecasting stock prices using machine learning algorithms and provides a comparison of different models.

Limitations

- The sample size was limited to five different stocks from five different industries.

- The data used in this study was historical and may not reflect future market trends.

Future Work

- Using more advanced machine learning algorithms, such as deep learning models.

- Incorporating additional features, such as economic indicators and news sentiment analysis.

- Evaluating the performance of different models on a larger dataset.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Comparative Study of Machine Learning Algorithms for Stock Price Prediction Using Insider Trading Data

Nelly Elsayed, Amitabh Chakravorty

Stock Market Prediction via Deep Learning Techniques: A Survey

Ehsan Abbasnejad, Lingqiao Liu, Javen Qinfeng Shi et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)