Authors

Summary

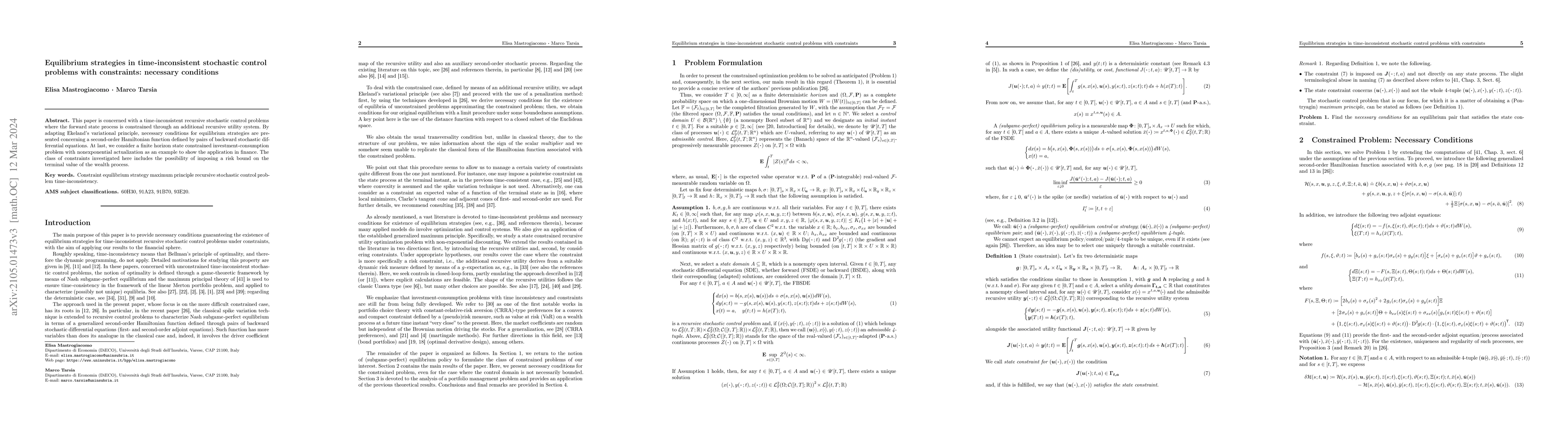

This paper is concerned with a time-inconsistent recursive stochastic control problems where the forward state process is constrained through an additional recursive utility system. By adapting the Ekeland variational principle, necessary conditions for equilibrium strategies are presented concerning a second-order Hamiltonian function defined by pairs of backward stochastic differential equations. At last, we consider a finite horizon state constrained investment-consumption problem with non-exponential actualisation as an example to show the application in finance. The class of constraints investigated here includes the possibility of imposing a risk bound on the terminal value of the wealth process.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)