Authors

Summary

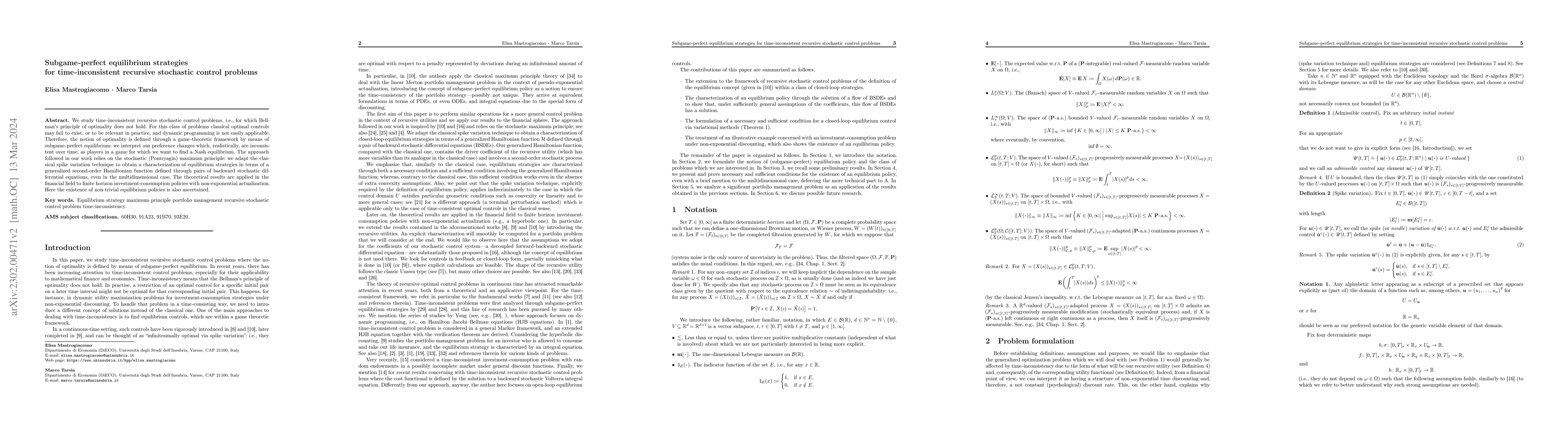

We study time-inconsistent recursive stochastic control problems, i.e., for which the Bellman principle of optimality does not hold. For this class of problems classical optimal controls may fail to exist, or to be relevant in practice, and dynamic programming is not easily applicable. Therefore, the notion of optimality is defined through a game-theoretic framework by means of subgame perfect equilibrium: we interpret our preference changes which, realistically, are inconsistent over time, as players in a game for which we want to find a Nash equilibrium. The approach followed in our work relies on the stochastic (Pontryagin) maximum principle: we adapt the classical spike variation technique to obtain a characterisation of equilibrium strategies in terms of a generalised second-order Hamiltonian function defined through pairs of backward stochastic differential equations, even in the multidimensional case. The theoretical results are applied in the financial field to finite horizon investment-consumption policies with non-exponential actualisation. Here the existence of non-trivial equilibrium policies is also ascertained.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)