Summary

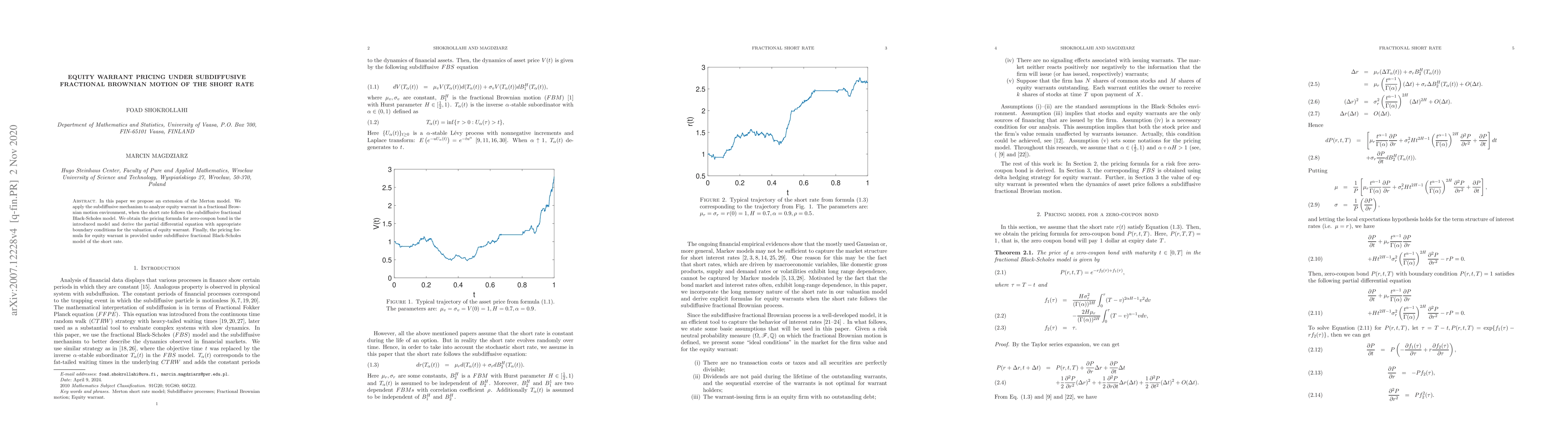

In this paper we propose an extension of the Merton model. We apply the subdiffusive mechanism to analyze equity warrant in a fractional Brownian motion environment, when the short rate follows the subdiffusive fractional Black-Scholes model. We obtain the pricing formula for zero-coupon bond in the introduced model and derive the partial differential equation with appropriate boundary conditions for the valuation of equity warrant. Finally, the pricing formula for equity warrant is provided under subdiffusive fractional Brownian motion model of the short rate.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)