Summary

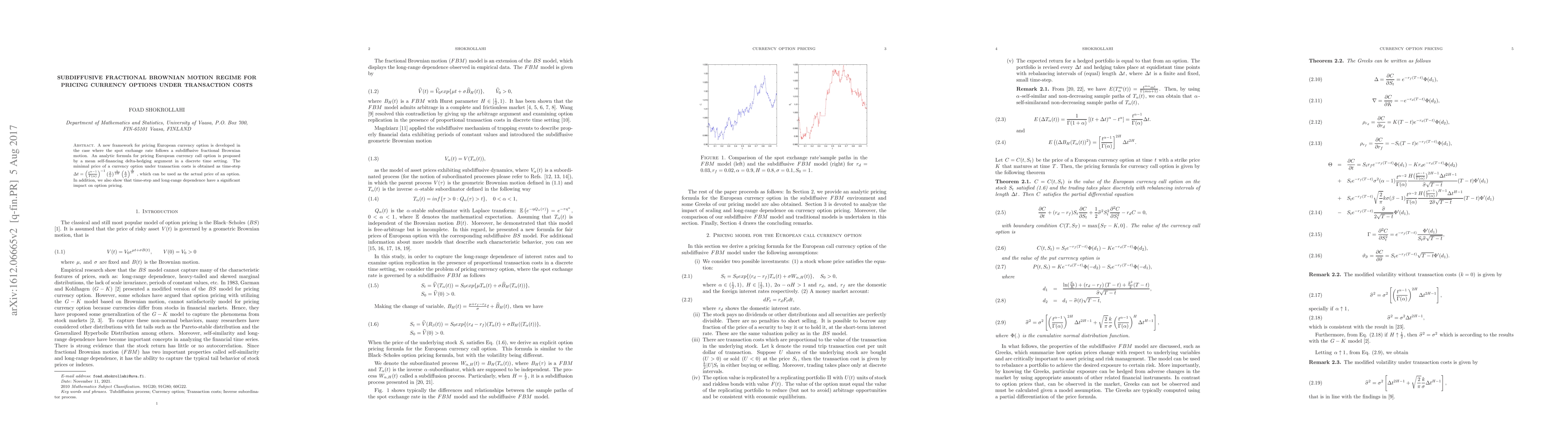

A new framework for pricing the European currency option is developed in the case where the spot exchange rate fellows a time-changed fractional Brownian motion. An analytic formula for pricing European foreign currency option is proposed by a mean self-financing delta-hedging argument in a discrete time setting. The minimal price of a currency option under transaction costs is obtained as time-step $\Delta t=\left(\frac{t^{\beta-1}}{\Gamma(\beta)}\right)^{-1}\left(\frac{2}{\pi}\right)^{\frac{1}{2H}}\left(\frac{\alpha}{\sigma}\right)^{\frac{1}{H}}$ , which can be used as the actual price of an option. In addition, we also show that time-step and long-range dependence have a significant impact on option pricing.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

No citations found for this paper.

Comments (0)