Summary

Geometric Brownian motion (GBM) is a model for systems as varied as financial instruments and populations. The statistical properties of GBM are complicated by non-ergodicity, which can lead to ensemble averages exhibiting exponential growth while any individual trajectory collapses according to its time-average. A common tactic for bringing time averages closer to ensemble averages is diversification. In this letter we study the effects of diversification using the concept of ergodicity breaking.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

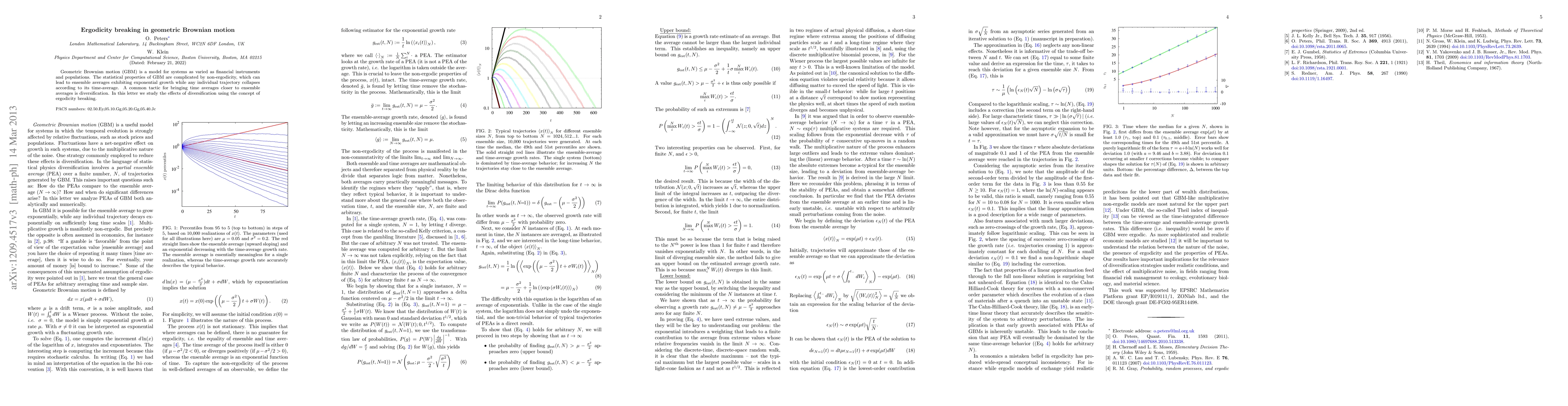

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersInfinite ergodicity for geometric Brownian motion

Stefano Giordano, Fabrizio Cleri, Ralf Blossey

Ergodicity breaking in wealth dynamics: The case of reallocating geometric Brownian motion

Viktor Stojkoski, Marko Karbevski

| Title | Authors | Year | Actions |

|---|

Comments (0)