Summary

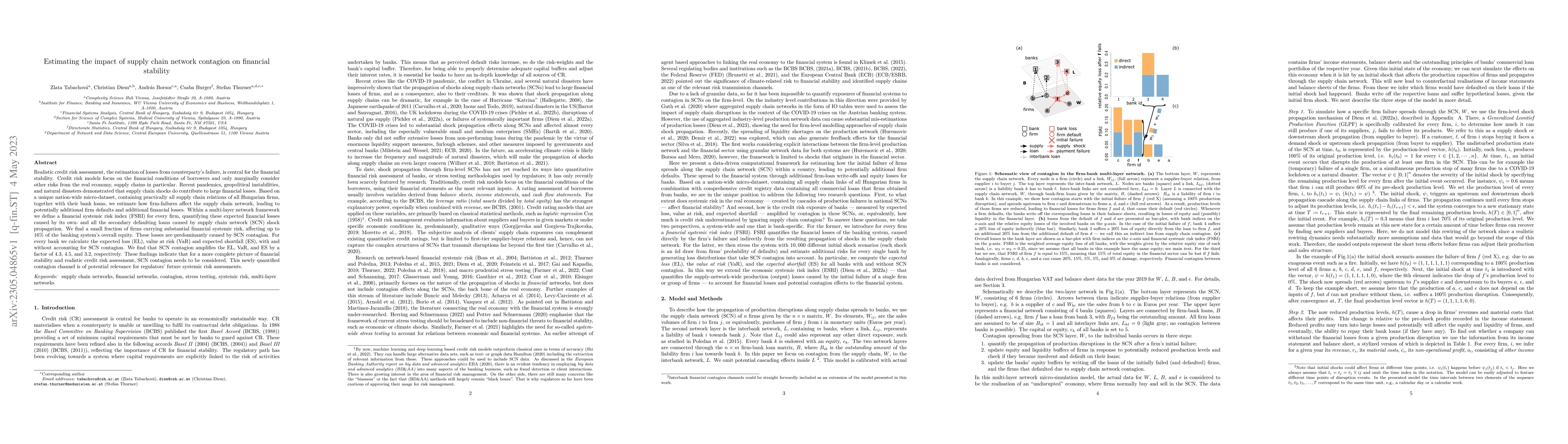

Realistic credit risk assessment, the estimation of losses from counterparty's failure, is central for the financial stability. Credit risk models focus on the financial conditions of borrowers and only marginally consider other risks from the real economy, supply chains in particular. Recent pandemics, geopolitical instabilities, and natural disasters demonstrated that supply chain shocks do contribute to large financial losses. Based on a unique nation-wide micro-dataset, containing practically all supply chain relations of all Hungarian firms, together with their bank loans, we estimate how firm-failures affect the supply chain network, leading to potentially additional firm defaults and additional financial losses. Within a multi-layer network framework we define a financial systemic risk index (FSRI) for every firm, quantifying these expected financial losses caused by its own- and all the secondary defaulting loans caused by supply chain network (SCN) shock propagation. We find a small fraction of firms carrying substantial financial systemic risk, affecting up to 16% of the banking system's overall equity. These losses are predominantly caused by SCN contagion. For every bank we calculate the expected loss (EL), value at risk (VaR) and expected shortfall (ES), with and without accounting for SCN contagion. We find that SCN contagion amplifies the EL, VaR, and ES by a factor of 4.3, 4.5, and 3.2, respectively. These findings indicate that for a more complete picture of financial stability and realistic credit risk assessment, SCN contagion needs to be considered. This newly quantified contagion channel is of potential relevance for regulators' future systemic risk assessments.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA data-driven econo-financial stress-testing framework to estimate the effect of supply chain networks on financial systemic risk

Stefan Thurner, András Borsos, Christian Diem et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)