Summary

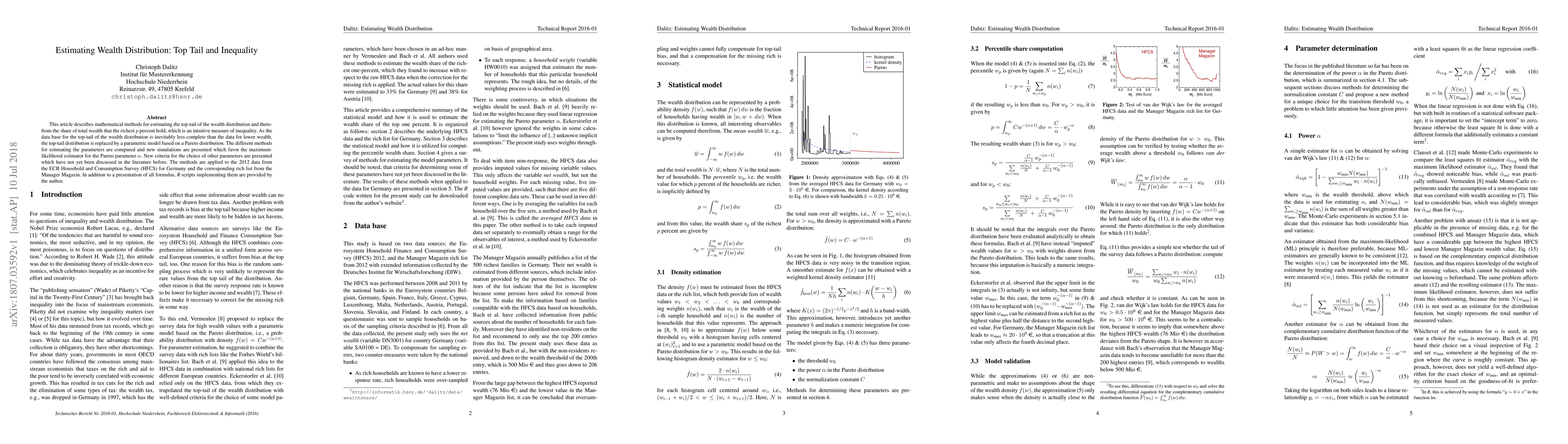

This article describes mathematical methods for estimating the top-tail of the wealth distribution and therefrom the share of total wealth that the richest $p$ percent hold, which is an intuitive measure of inequality. As the data base for the top-tail of the wealth distribution is inevitably less complete than the data for lower wealth, the top-tail distribution is replaced by a parametric model based on a Pareto distribution. The different methods for estimating the parameters are compared and new simulations are presented which favor the maximum-likelihood estimator for the Pareto parameter $\alpha$. New criteria for the choice of other parameters are presented which have not yet been discussed in the literature before. The methods are applied to the 2012 data from the ECB Household and Consumption Survey (HFCS) for Germany and the corresponding rich list from the Manager Magazin. In addition to a presentation of all formulas, R scripts implementing them are provided by the author.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)