Summary

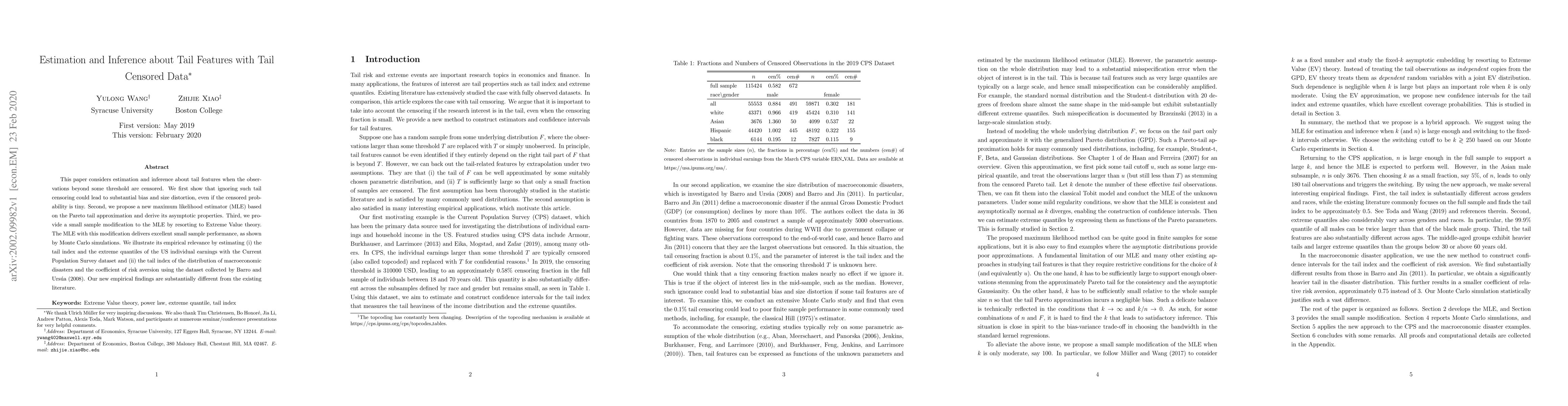

This paper considers estimation and inference about tail features when the observations beyond some threshold are censored. We first show that ignoring such tail censoring could lead to substantial bias and size distortion, even if the censored probability is tiny. Second, we propose a new maximum likelihood estimator (MLE) based on the Pareto tail approximation and derive its asymptotic properties. Third, we provide a small sample modification to the MLE by resorting to Extreme Value theory. The MLE with this modification delivers excellent small sample performance, as shown by Monte Carlo simulations. We illustrate its empirical relevance by estimating (i) the tail index and the extreme quantiles of the US individual earnings with the Current Population Survey dataset and (ii) the tail index of the distribution of macroeconomic disasters and the coefficient of risk aversion using the dataset collected by Barro and Urs{\'u}a (2008). Our new empirical findings are substantially different from the existing literature.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBayesian composite confidence interval for the tail index under randomly right-censored data

Abdelkader Ameraoui, Jean-François Dupuy, Kamal Boukhetala

| Title | Authors | Year | Actions |

|---|

Comments (0)