Authors

Summary

A point process for event arrivals in high frequency trading is presented. The intensity is the product of a Hawkes process and high dimensional functions of covariates derived from the order book. Conditions for stationarity of the process are stated. An algorithm is presented to estimate the model even in the presence of billions of data points, possibly mapping covariates into a high dimensional space. The large sample size can be common for high frequency data applications using multiple liquid instruments. Convergence of the algorithm is shown, consistency results under weak conditions is established, and a test statistic to assess out of sample performance of different model specifications is suggested. The methodology is applied to the study of four stocks that trade on the New York Stock Exchange (NYSE). The out of sample testing procedure suggests that capturing the nonlinearity of the order book information adds value to the self exciting nature of high frequency trading events.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

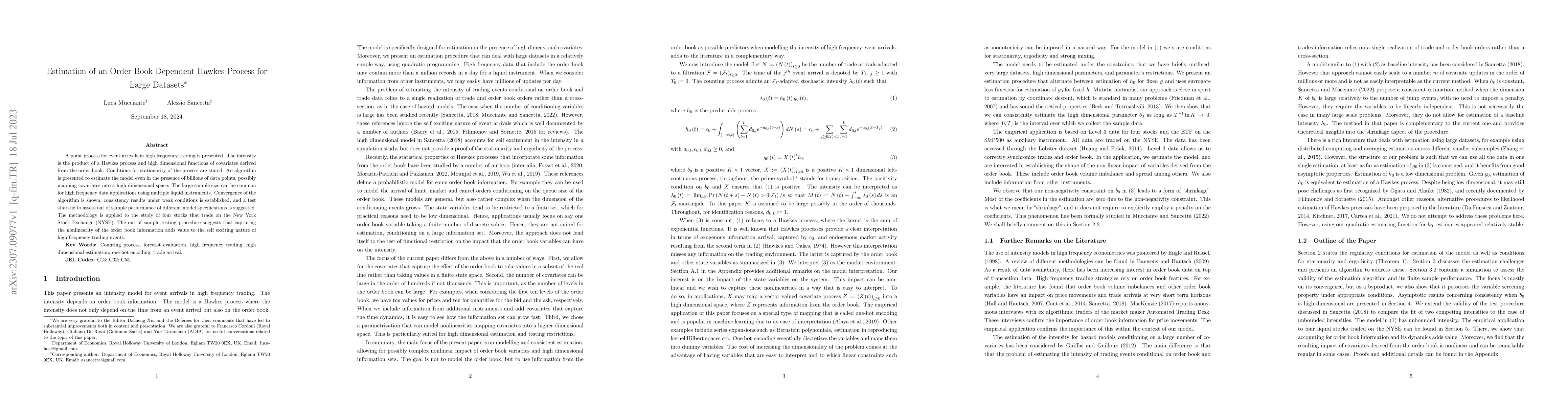

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOrder Book Queue Hawkes-Markovian Modeling

Shihao Yang, Philip Protter, Qianfan Wu

Limit Order Book Dynamics and Order Size Modelling Using Compound Hawkes Process

Philip Treleaven, Konark Jain, Nick Firoozye et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)