Summary

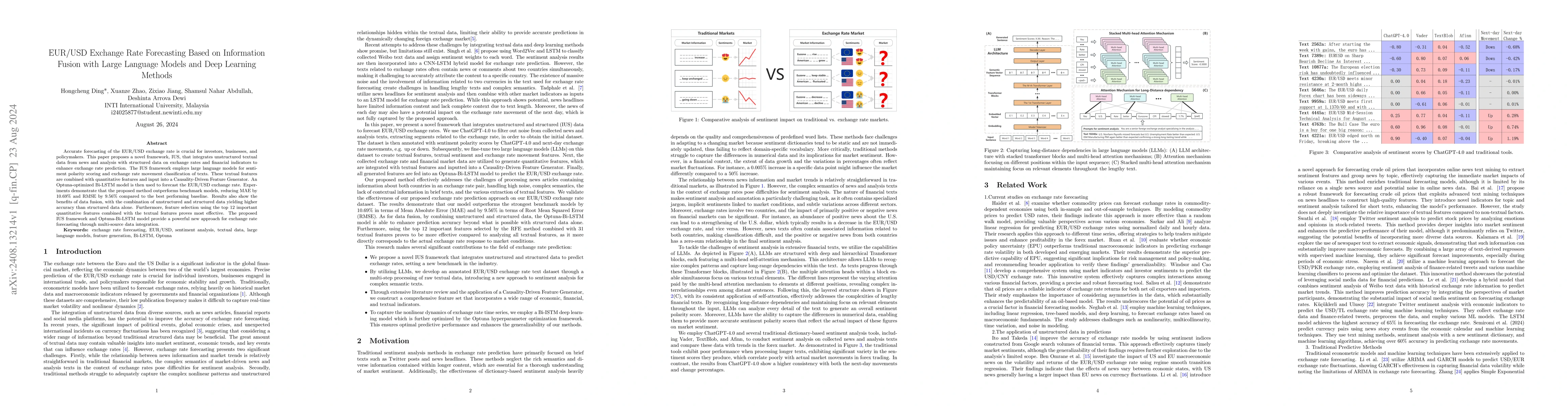

Accurate forecasting of the EUR/USD exchange rate is crucial for investors, businesses, and policymakers. This paper proposes a novel framework, IUS, that integrates unstructured textual data from news and analysis with structured data on exchange rates and financial indicators to enhance exchange rate prediction. The IUS framework employs large language models for sentiment polarity scoring and exchange rate movement classification of texts. These textual features are combined with quantitative features and input into a Causality-Driven Feature Generator. An Optuna-optimized Bi-LSTM model is then used to forecast the EUR/USD exchange rate. Experiments demonstrate that the proposed method outperforms benchmark models, reducing MAE by 10.69% and RMSE by 9.56% compared to the best performing baseline. Results also show the benefits of data fusion, with the combination of unstructured and structured data yielding higher accuracy than structured data alone. Furthermore, feature selection using the top 12 important quantitative features combined with the textual features proves most effective. The proposed IUS framework and Optuna-Bi-LSTM model provide a powerful new approach for exchange rate forecasting through multi-source data integration.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEUR/USD Exchange Rate Forecasting incorporating Text Mining Based on Pre-trained Language Models and Deep Learning Methods

Xiangyu Shi, Hongcheng Ding, Shamsul Nahar Abdullah et al.

Enhancing Exchange Rate Forecasting with Explainable Deep Learning Models

Shuchen Meng, Fangyu Wu, Haowei Ni et al.

Predicting Foreign Exchange EUR/USD direction using machine learning

Kevin Cedric Guyard, Michel Deriaz

No citations found for this paper.

Comments (0)