Summary

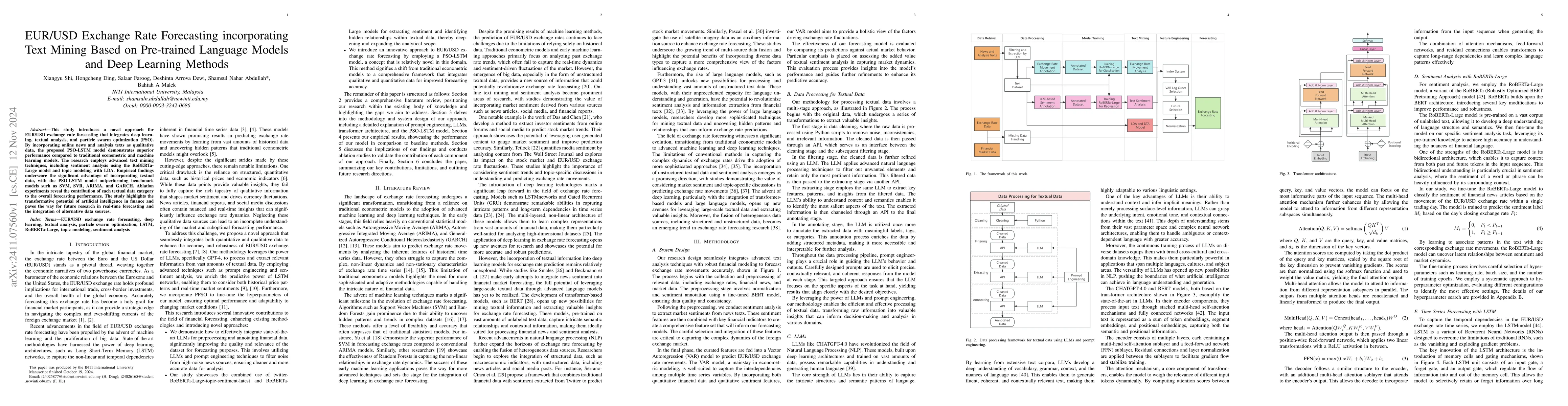

This study introduces a novel approach for EUR/USD exchange rate forecasting that integrates deep learning, textual analysis, and particle swarm optimization (PSO). By incorporating online news and analysis texts as qualitative data, the proposed PSO-LSTM model demonstrates superior performance compared to traditional econometric and machine learning models. The research employs advanced text mining techniques, including sentiment analysis using the RoBERTa-Large model and topic modeling with LDA. Empirical findings underscore the significant advantage of incorporating textual data, with the PSO-LSTM model outperforming benchmark models such as SVM, SVR, ARIMA, and GARCH. Ablation experiments reveal the contribution of each textual data category to the overall forecasting performance. The study highlights the transformative potential of artificial intelligence in finance and paves the way for future research in real-time forecasting and the integration of alternative data sources.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersEUR-USD Exchange Rate Forecasting Based on Information Fusion with Large Language Models and Deep Learning Methods

Hongcheng Ding, Xuanze Zhao, Shamsul Nahar Abdullah et al.

Enhancing Exchange Rate Forecasting with Explainable Deep Learning Models

Shuchen Meng, Fangyu Wu, Haowei Ni et al.

Predicting Foreign Exchange EUR/USD direction using machine learning

Kevin Cedric Guyard, Michel Deriaz

No citations found for this paper.

Comments (0)