Summary

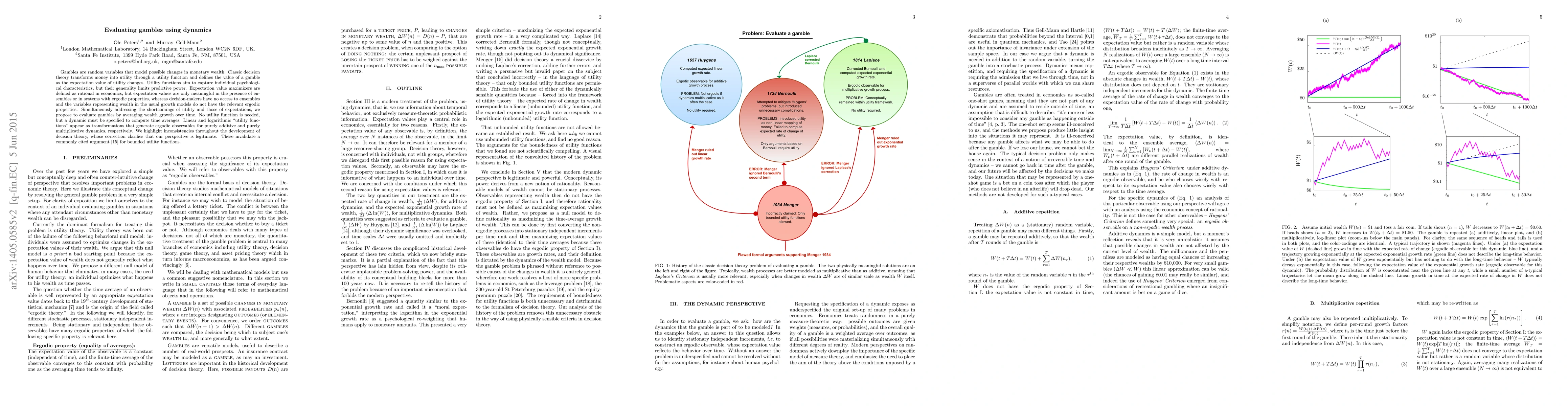

Gambles are random variables that model possible changes in monetary wealth. Classic decision theory transforms money into utility through a utility function and defines the value of a gamble as the expectation value of utility changes. Utility functions aim to capture individual psychological characteristics, but their generality limits predictive power. Expectation value maximizers are defined as rational in economics, but expectation values are only meaningful in the presence of ensembles or in systems with ergodic properties, whereas decision-makers have no access to ensembles and the variables representing wealth in the usual growth models do not have the relevant ergodic properties. Simultaneously addressing the shortcomings of utility and those of expectations, we propose to evaluate gambles by averaging wealth growth over time. No utility function is needed, but a dynamic must be specified to compute time averages. Linear and logarithmic "utility functions" appear as transformations that generate ergodic observables for purely additive and purely multiplicative dynamics, respectively. We highlight inconsistencies throughout the development of decision theory, whose correction clarifies that our perspective is legitimate. These invalidate a commonly cited argument for bounded utility functions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFunction-Coherent Gambles with Non-Additive Sequential Dynamics

Gregory Wheeler

Distinguishing Risk Preferences using Repeated Gambles

James Price, Colm Connaughton

| Title | Authors | Year | Actions |

|---|

Comments (0)