Summary

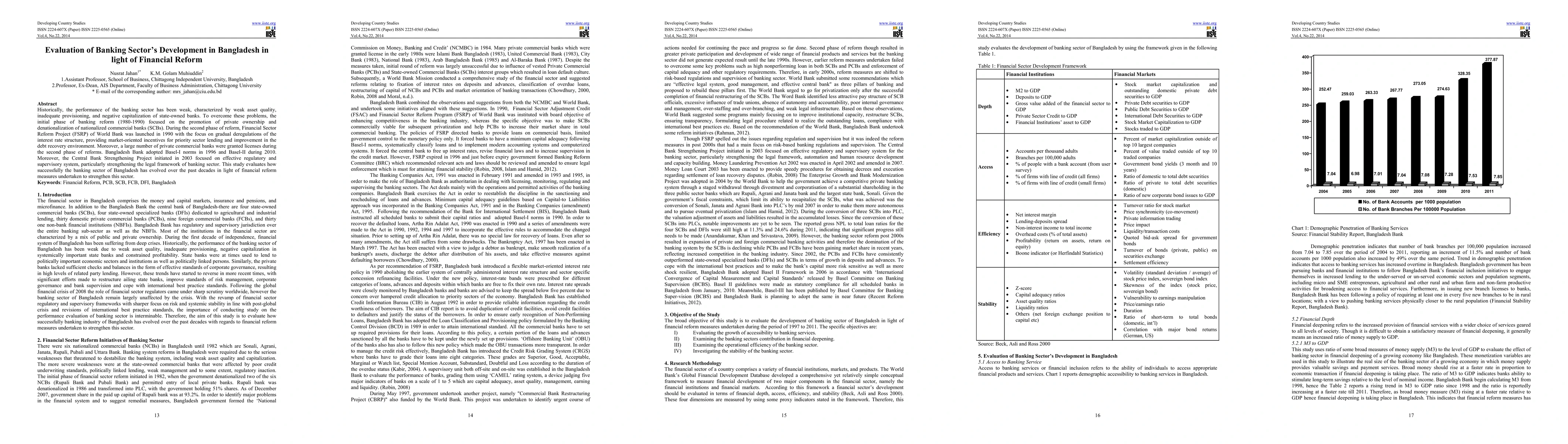

Historically, the performance of the banking sector has been weak, characterized by weak asset quality, inadequate provisioning, and negative capitalization of state-owned banks. To overcome these problems, the initial phase of banking reform (1980-1990) focused on the promotion of private ownership and denationalization of nationalized commercial banks (SCBs). During the second phase of reform, Financial Sector Reform Project (FSRP) of World Bank was launched in 1990 with the focus on gradual deregulations of the interest rate structure, providing market-oriented incentives for priority sector lending and improvement in the debt recovery environment. Moreover, a large number of private commercial banks were granted licenses during the second phase of reforms. Bangladesh Bank adopted Basel-I norms in 1996 and Basel-II during 2010. Moreover, the Central Bank Strengthening Project initiated in 2003 focused on effective regulatory and supervisory system, particularly strengthening the legal framework of banking sector. This study evaluates how successfully the banking sector of Bangladesh has evolved over the past decades in light of financial reform measures undertaken to strengthen this sector.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMeasuring the Macroeconomic and Financial Stability of Bangladesh

Faruque Ahamed, Md Ataur Rahman Chowdhury

Analyzing the Impact of Financial Inclusion on Economic Growth in Bangladesh

Ganapati Kumar Biswas

Digital financial services and open banking innovation: are banks becoming invisible?

Pierluigi Toma, Valeria Stefanelli, Francesco Manta

| Title | Authors | Year | Actions |

|---|

Comments (0)