Summary

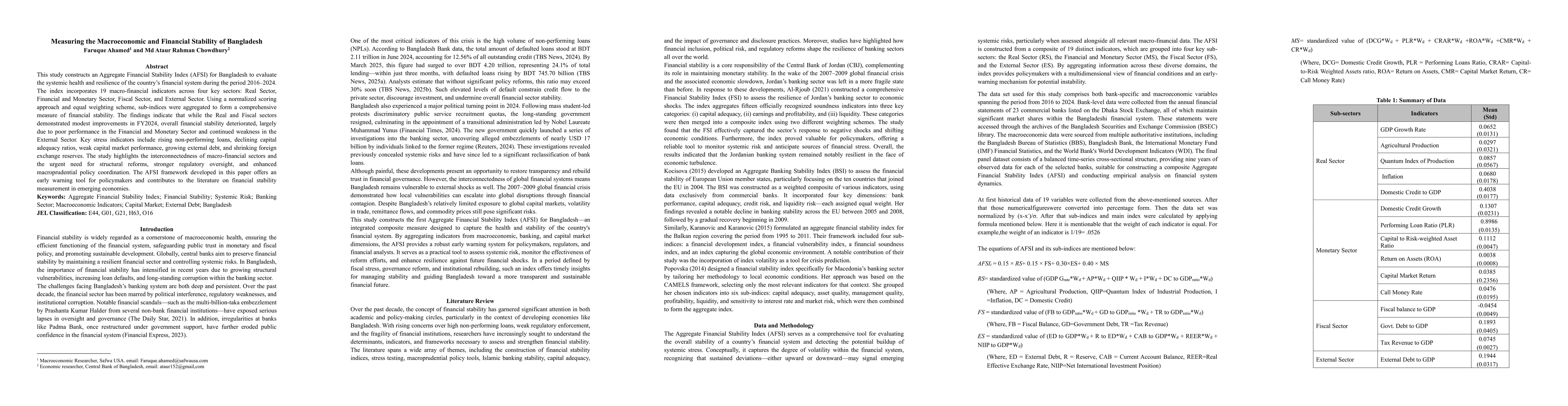

This study constructs an Aggregate Financial Stability Index (AFSI) for Bangladesh to evaluate the systemic health and resilience of the countrys financial system during the period from 2016 to 2024. The index incorporates 19 macrofinancial indicators across four key sectors Real Sector, Financial and Monetary Sector, Fiscal Sector and External Sector. Using a normalized scoring approach and equal weighting scheme, sub-indices were aggregated to form a comprehensive measure of financial stability. The findings indicate that while the Real and Fiscal sectors demonstrated modest improvements in FY2024, overall financial stability deteriorated, largely due to poor performance in the Financial and Monetary Sector and continued weakness in the External Sector. Key stress indicators include rising non-performing loans, declining capital adequacy ratios, weak capital market performance, growing external debt, and shrinking foreign exchange reserves. The study highlights the interconnectedness of macro-financial sectors and the urgent need for structural reforms, stronger regulatory oversight, and enhanced macroprudential policy coordination. The AFSI framework developed in this paper offers an early warning tool for policymakers and contributes to the literature on financial stability measurement in emerging economies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)