Summary

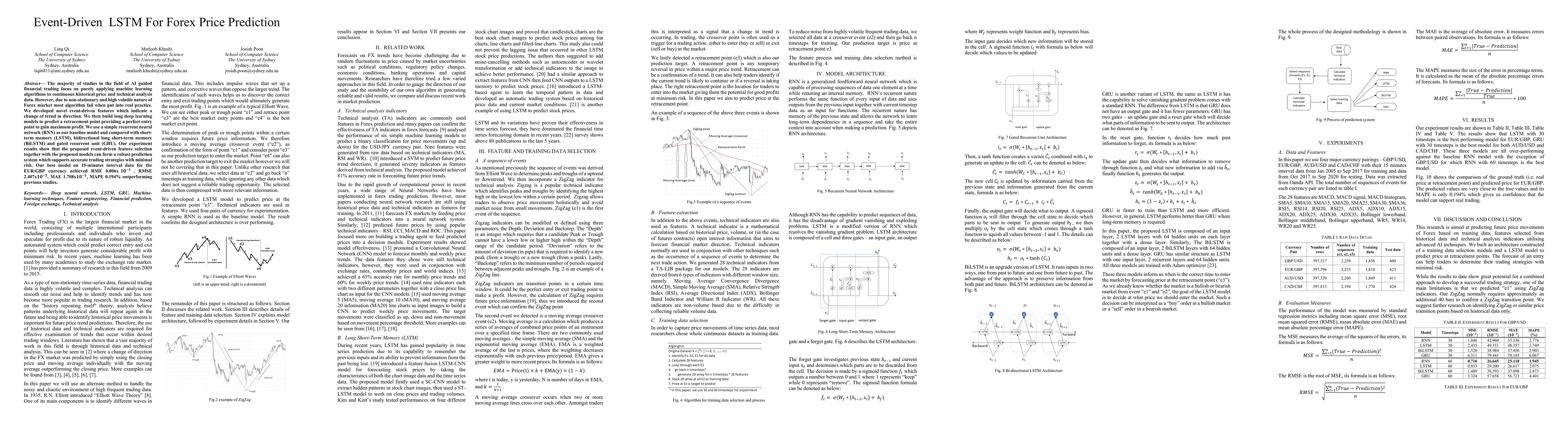

The majority of studies in the field of AI guided financial trading focus on purely applying machine learning algorithms to continuous historical price and technical analysis data. However, due to non-stationary and high volatile nature of Forex market most algorithms fail when put into real practice. We developed novel event-driven features which indicate a change of trend in direction. We then build long deep learning models to predict a retracement point providing a perfect entry point to gain maximum profit. We use a simple recurrent neural network (RNN) as our baseline model and compared with short-term memory (LSTM), bidirectional long short-term memory (BiLSTM) and gated recurrent unit (GRU). Our experiment results show that the proposed event-driven feature selection together with the proposed models can form a robust prediction system which supports accurate trading strategies with minimal risk. Our best model on 15-minutes interval data for the EUR/GBP currency achieved RME 0.006x10^(-3) , RMSE 2.407x10^(-3), MAE 1.708x10^(-3), MAPE 0.194% outperforming previous studies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)