Summary

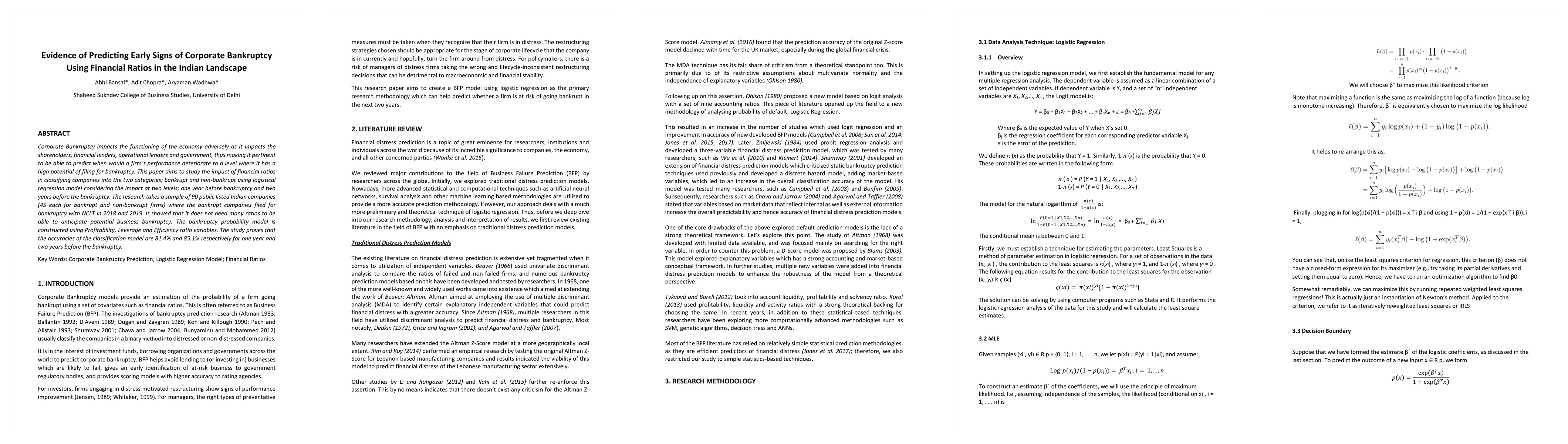

Corporate bankruptcy impacts the functioning of the economy as it impacts its various stakeholders: Shareholders, financial and operational lenders, and the government. This paper aims to study the impact of a wide array of profitability, leverage and efficiency ratios to predict early signs of bankruptcy in public listed companies in India using a logistic regression considering impacts at two levels: one year and two years before the filing of bankruptcy with the NCLT during the year 2019. The study proves that the accuracies of the classification model are 81.4% and 85.1% respectively for one year and two years before the bankruptcy.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAugmenting Bankruptcy Prediction using Reported Behavior of Corporate Restructuring

Xinlin Wang, Mats Brorsson

Corporate Bankruptcy Prediction with Domain-Adapted BERT

Alex Kim, Sangwon Yoon

No citations found for this paper.

Comments (0)