Authors

Summary

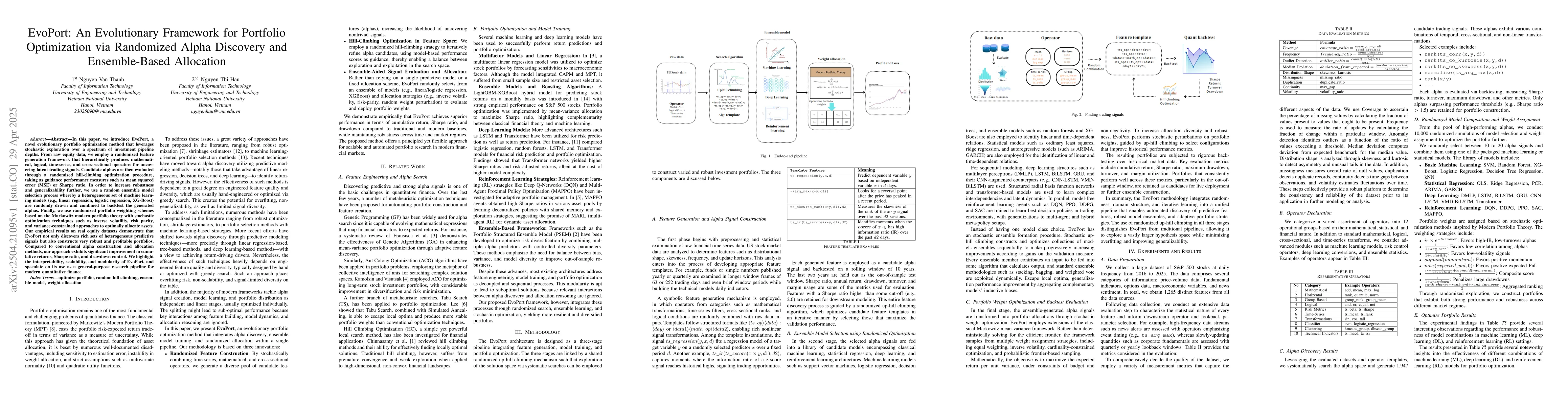

In this paper, we introduce EvoPort, a novel evolutionary portfolio optimization method that leverages stochastic exploration over a spectrum of investment pipeline depths. From raw equity data, we employ a randomized feature generation framework that hierarchically produces mathematical, logical, time-series, and cross-sectional operators for uncovering latent trading signals. Candidate alphas are then evaluated through a randomized hill-climbing optimization procedure, taking as guidance performance measures such as mean squared error (MSE) or Sharpe ratio. In order to increase robustness and generalizability further, we use a random ensemble model selection process whereby a heterogeneous set of machine learning models (e.g., linear regression, logistic regression, XG-Boost) are randomly drawn and combined to backtest the generated alphas. Finally, we use randomized portfolio weighting schemes based on the Markowitz modern portfolio theory with stochastic optimization techniques such as inverse volatility, risk parity, and variance-constrained approaches to optimally allocate assets. Our empirical results on real equity datasets demonstrate that EvoPort not only discovers rich sets of heterogeneous predictive signals but also constructs very robust and profitable portfolios. Compared to conventional alpha construction and allocation methods, our approach exhibits significant improvement in cumulative returns, Sharpe ratio, and drawdown control. We highlight the interpretability, scalability, and modularity of EvoPort, and speculate on its use as a general-purpose research pipeline for modern quantitative finance.

AI Key Findings

Generated Jun 08, 2025

Methodology

EvoPort introduces an evolutionary framework for portfolio optimization, utilizing randomized feature generation, hill-climbing optimization, random ensemble model selection, and stochastic portfolio weighting schemes to discover and allocate assets.

Key Results

- EvoPort discovers rich sets of heterogeneous predictive signals from raw equity data.

- Constructed portfolios exhibit significant improvement in cumulative returns, Sharpe ratio, and drawdown control compared to conventional methods.

Significance

This research presents a novel, interpretable, scalable, and modular approach to portfolio optimization, with potential applications in modern quantitative finance.

Technical Contribution

EvoPort's main technical contribution lies in its evolutionary framework combining randomized alpha discovery, ensemble-based allocation, and stochastic optimization techniques for portfolio construction.

Novelty

EvoPort's novelty stems from its hierarchical feature generation, randomized optimization, and ensemble model selection, which enhance interpretability, scalability, and robustness in portfolio optimization.

Limitations

- The paper does not discuss limitations explicitly, implying further research could explore the method's performance under various market conditions or with additional asset classes.

- Generalizability to non-equity datasets or alternative financial instruments remains to be explored.

Future Work

- Investigate EvoPort's performance with diverse asset classes and alternative data sources.

- Explore the method's adaptability to dynamic market conditions and regime changes.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAn Efficient Dynamic Resource Allocation Framework for Evolutionary Bilevel Optimization

Kai Ye, Min Jiang, Dejun Xu et al.

Developing An Attention-Based Ensemble Learning Framework for Financial Portfolio Optimisation

Zhenglong Li, Vincent Tam

Onflow: an online portfolio allocation algorithm

Gabriel Turinici, Pierre Brugiere

No citations found for this paper.

Comments (0)