Authors

Summary

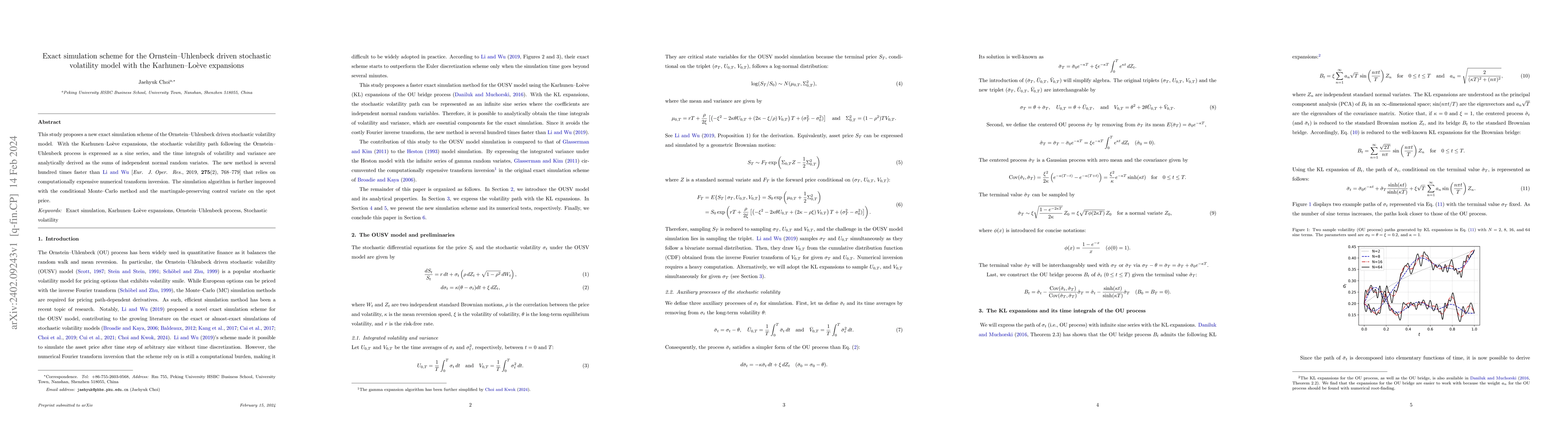

This study proposes a new exact simulation scheme of the Ornstein-Uhlenbeck driven stochastic volatility model. With the Karhunen-Lo\`eve expansions, the stochastic volatility path following the Ornstein-Uhlenbeck process is expressed as a sine series, and the time integrals of volatility and variance are analytically derived as the sums of independent normal random variates. The new method is several hundred times faster than Li and Wu [Eur. J. Oper. Res., 2019, 275(2), 768-779] that relies on computationally expensive numerical transform inversion. The simulation algorithm is further improved with the conditional Monte-Carlo method and the martingale-preserving control variate on the spot price.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)