Authors

Summary

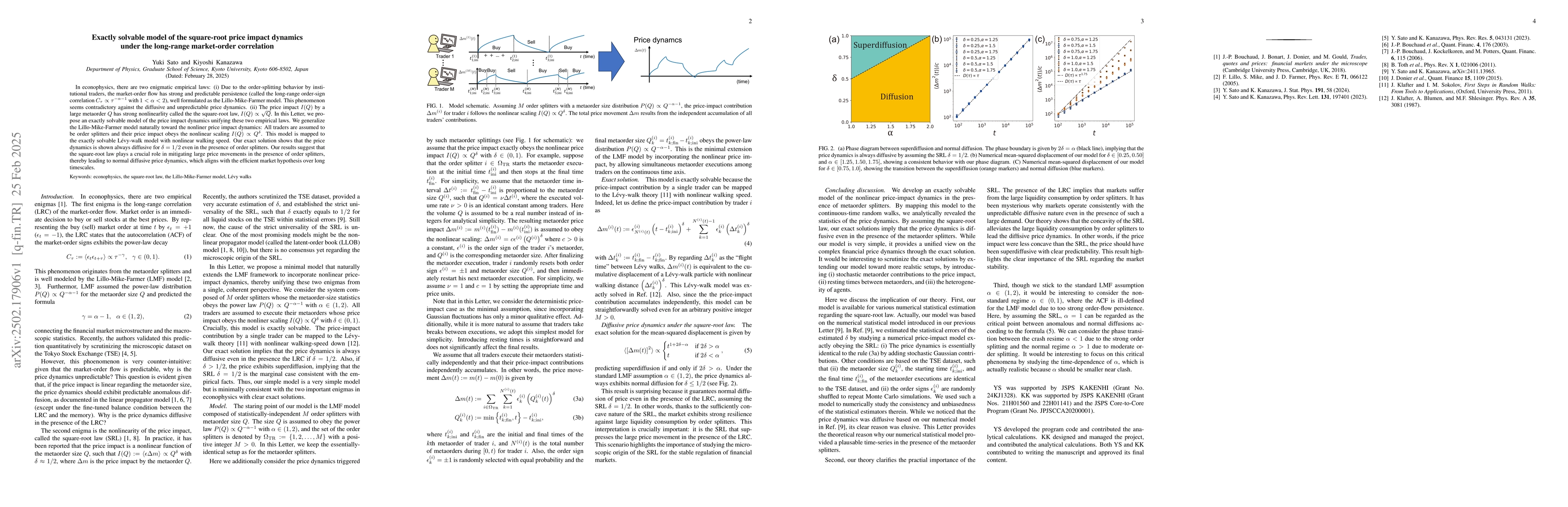

In econophysics, there are two enigmatic empirical laws: (i) Due to the order-splitting behavior by institutional traders, the market-order flow has strong and predictable persistence (called the long-range order-sign correlation $C_\tau\propto \tau^{-\alpha-1}$ with $1<\alpha<2$), well formulated as the Lillo-Mike-Farmer model. This phenomenon seems contradictory against the diffusive and unpredictable price dynamics. (ii) The price impact $I(Q)$ by a large metaorder $Q$ has strong nonlinearlity called the the square-root law, $I(Q)\propto \sqrt{Q}$. In this Letter, we propose an exactly solvable model of the price impact dynamics unifying these two empirical laws. We generalize the Lillo-Mike-Farmer model naturally toward the nonliner price impact dynamics: All traders are assumed to be order splitters and their price impact obeys the nonlinear scaling $I(Q)\propto Q^{\delta}$. This model is mapped to the exactly solvable L\'evy-walk model with nonlinear walking speed. Our exact solution shows that the price dynamics is shown always diffusive for $\delta=1/2$ even in the presence of order splitters. Our results suggest that the square-root law plays a crucial role in mitigating large price movements in the presence of order splitters, thereby leading to normal diffusive price dynamics, which aligns with the efficient market hypothesis over long timescales.

AI Key Findings

Generated Jun 11, 2025

Methodology

The research proposes an exactly solvable model that unifies two empirical laws in econophysics: the long-range order-sign correlation of market-order flow and the square-root price impact law. It generalizes the Lillo-Mike-Farmer model to incorporate nonlinear price impact dynamics, mapping it to an exactly solvable Lévy-walk model with nonlinear walking speed.

Key Results

- The model shows that the square-root law mitigates large price movements, leading to normal diffusive price dynamics.

- The exact solution demonstrates that price dynamics remain diffusive for δ=1/2, even with order splitters.

- The inverse-cubic law for price movements is derived and shown to align with empirical observations.

- Numerical simulations confirm the theoretical predictions for mean-squared displacement, power-law price changes, and volatility clustering.

Significance

This work is significant as it provides a theoretical framework that reconciles two puzzling empirical laws in financial markets, offering insights into market efficiency and price dynamics.

Technical Contribution

The paper introduces an exactly solvable model that integrates long-range order-sign correlation with nonlinear price impact dynamics, providing an analytical solution for price movement characteristics.

Novelty

The model's novelty lies in its ability to unify two distinct empirical laws in financial markets through a solvable mathematical framework, offering new insights into market efficiency and price dynamics.

Limitations

- The model assumes all traders are order splitters, which may not reflect real-world diversity in trading behaviors.

- The study focuses on specific forms of price impact and market-order correlation, which might limit its applicability to more complex market scenarios.

Future Work

- Investigate the model's applicability to diverse market conditions and trading behaviors.

- Explore extensions to incorporate more complex price impact functions and market-order correlation patterns.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe two square root laws of market impact and the role of sophisticated market participants

Mathieu Rosenbaum, Grégoire Szymanski, Bruno Durin

The Subtle Interplay between Square-root Impact, Order Imbalance & Volatility: A Unifying Framework

Jean-Philippe Bouchaud, Guillaume Maitrier

No citations found for this paper.

Comments (0)