Kiyoshi Kanazawa

13 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

A standard form of master equations for general non-Markovian jump processes: the Laplace-space embedding framework and asymptotic solution

We present a standard form of master equations (ME) for general one-dimensional non-Markovian (history-dependent) jump processes, complemented by an asymptotic solution derived from an expanded syst...

Quantitative statistical analysis of order-splitting behaviour of individual trading accounts in the Japanese stock market over nine years

In this research, we focus on the order-splitting behavior. The order splitting is a trading strategy to execute their large potential metaorder into small pieces to reduce transaction cost. This st...

Exact solution to a generalised Lillo-Mike-Farmer model with heterogeneous order-splitting strategies

The Lillo-Mike-Farmer (LMF) model is an established econophysics model describing the order-splitting behaviour of institutional investors in financial markets. In the original article (LMF, Physica...

Can we infer microscopic financial information from the long memory in market-order flow?: a quantitative test of the Lillo-Mike-Farmer model

In financial markets, the market order sign exhibits strong persistence, widely known as the long-range correlation (LRC) of order flow; specifically, the sign correlation function displays long mem...

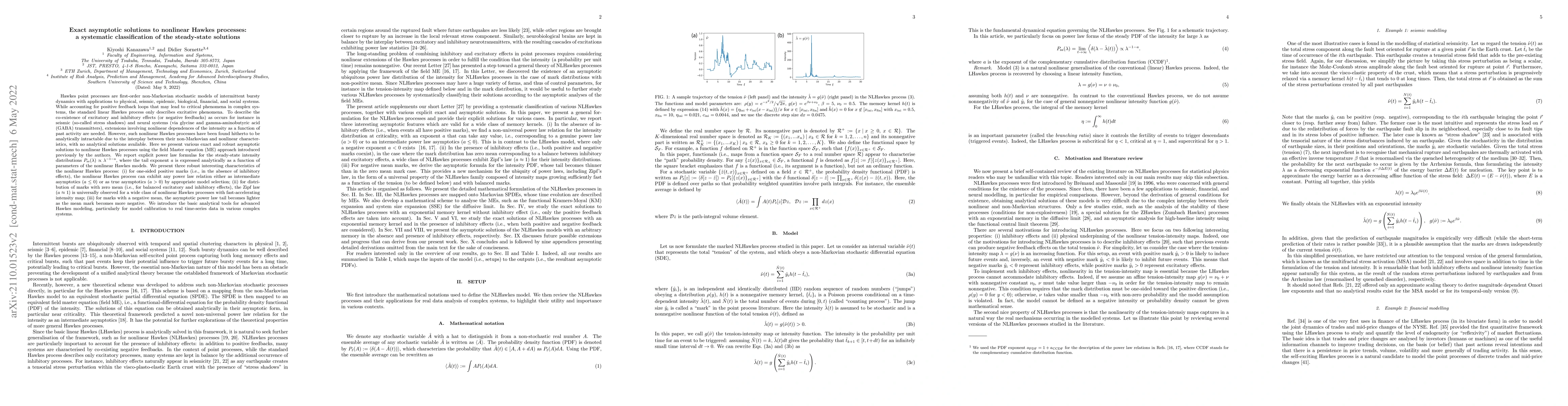

Exact solution to two-body financial dealer model: revisited from the viewpoint of kinetic theory

The two-body stochastic dealer model is revisited to provide an exact solution to the average order-book profile using the kinetic approach. The dealer model is a microscopic financial model where i...

Social physics

Recent decades have seen a rise in the use of physics methods to study different societal phenomena. This development has been due to physicists venturing outside of their traditional domains of int...

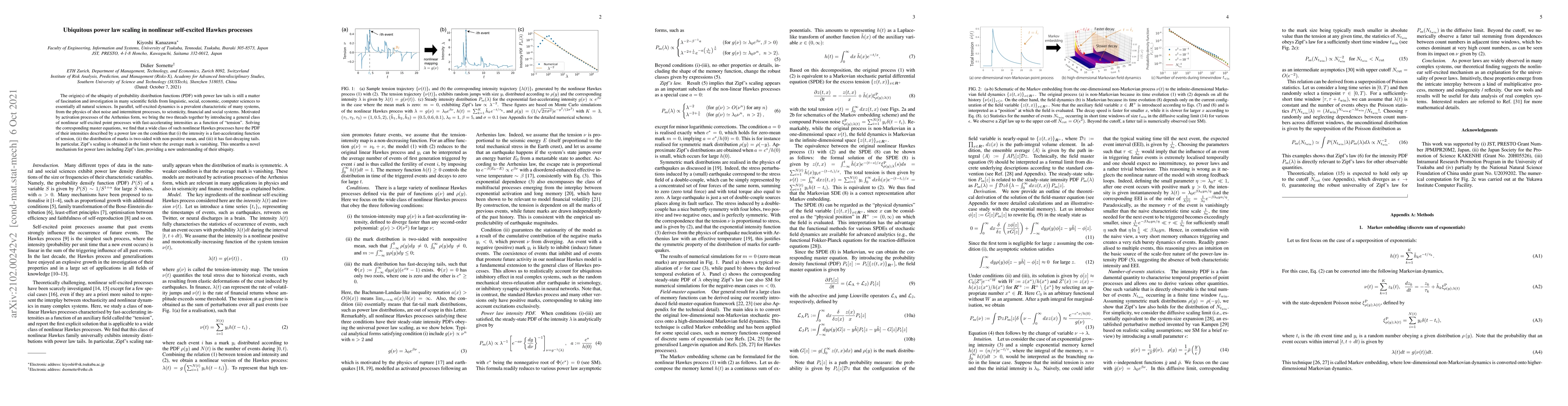

Exact asymptotic solutions to nonlinear Hawkes processes: a systematic classification of the steady-state solutions

Hawkes point processes are first-order non-Markovian stochastic models of intermittent bursty dynamics with applications to physical, seismic, epidemic, biological, financial, and social systems. Wh...

Ubiquitous power law scaling in nonlinear self-excited Hawkes processes

The origin(s) of the ubiquity of probability distribution functions (PDF) with power law tails is still a matter of fascination and investigation in many scientific fields from linguistic, social, e...

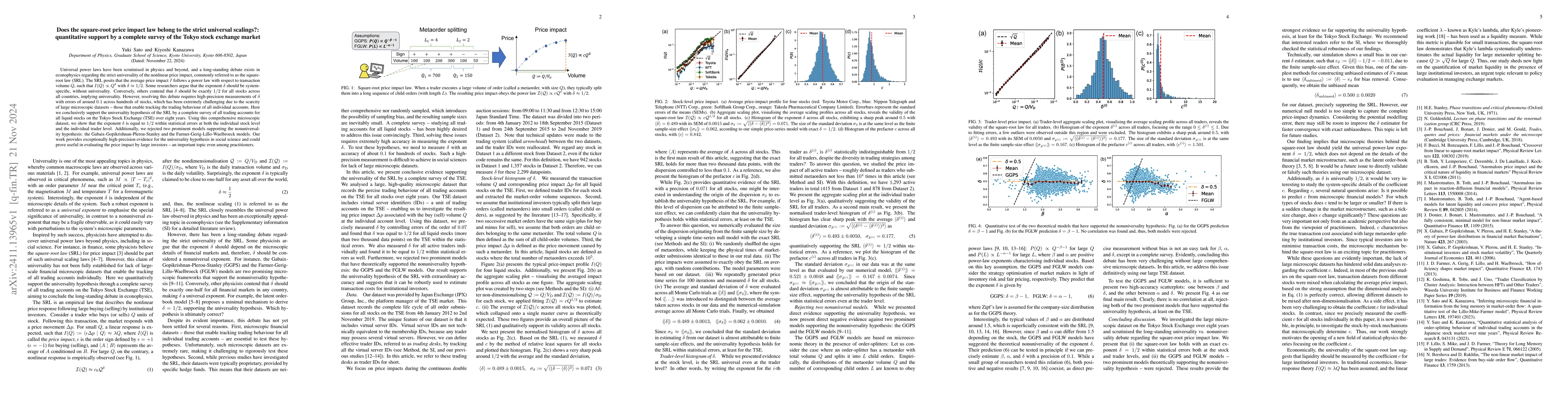

Does the square-root price impact law belong to the strict universal scalings?: quantitative support by a complete survey of the Tokyo stock exchange market

Universal power laws have been scrutinised in physics and beyond, and a long-standing debate exists in econophysics regarding the strict universality of the nonlinear price impact, commonly referred t...

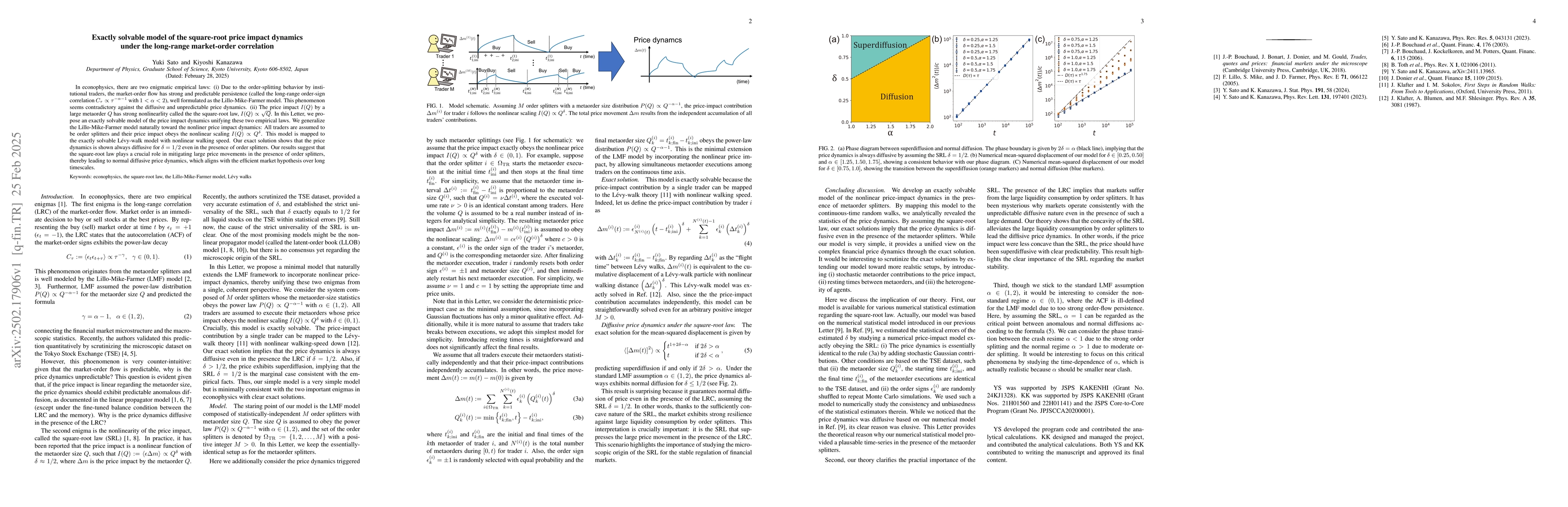

Exactly solvable model of the square-root price impact dynamics under the long-range market-order correlation

In econophysics, there are two enigmatic empirical laws: (i) Due to the order-splitting behavior by institutional traders, the market-order flow has strong and predictable persistence (called the long...

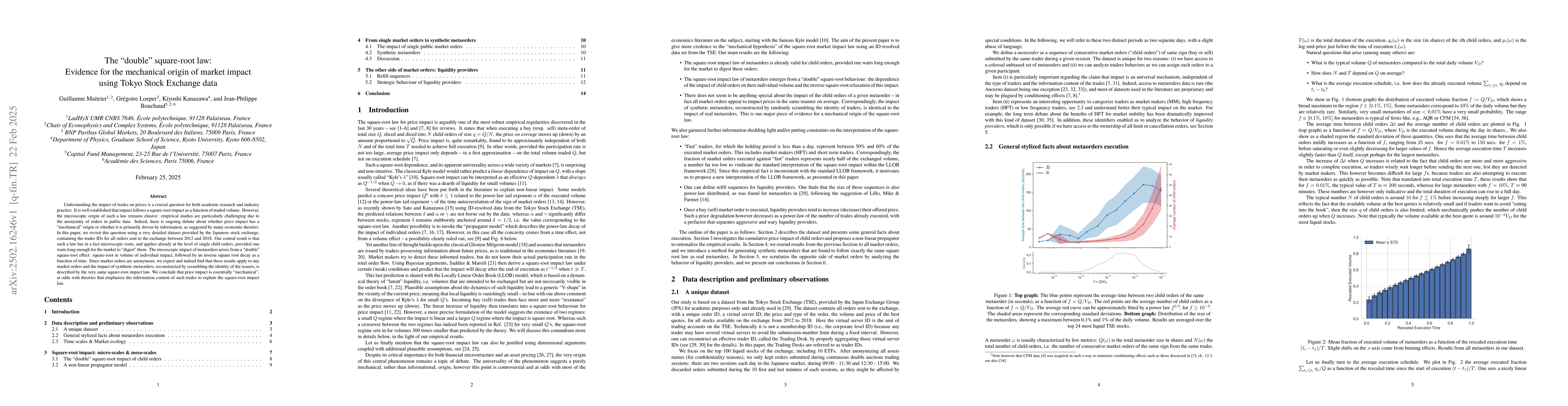

The "double" square-root law: Evidence for the mechanical origin of market impact using Tokyo Stock Exchange data

Understanding the impact of trades on prices is a crucial question for both academic research and industry practice. It is well established that impact follows a square-root impact as a function of tr...

Stochastic thermodynamics for classical non-Markov jump processes

Stochastic thermodynamics investigates energetic/entropic bounds in small systems, such as biomolecular motors, chemical-reaction networks, and quantum nano-devices. Foundational results, including th...

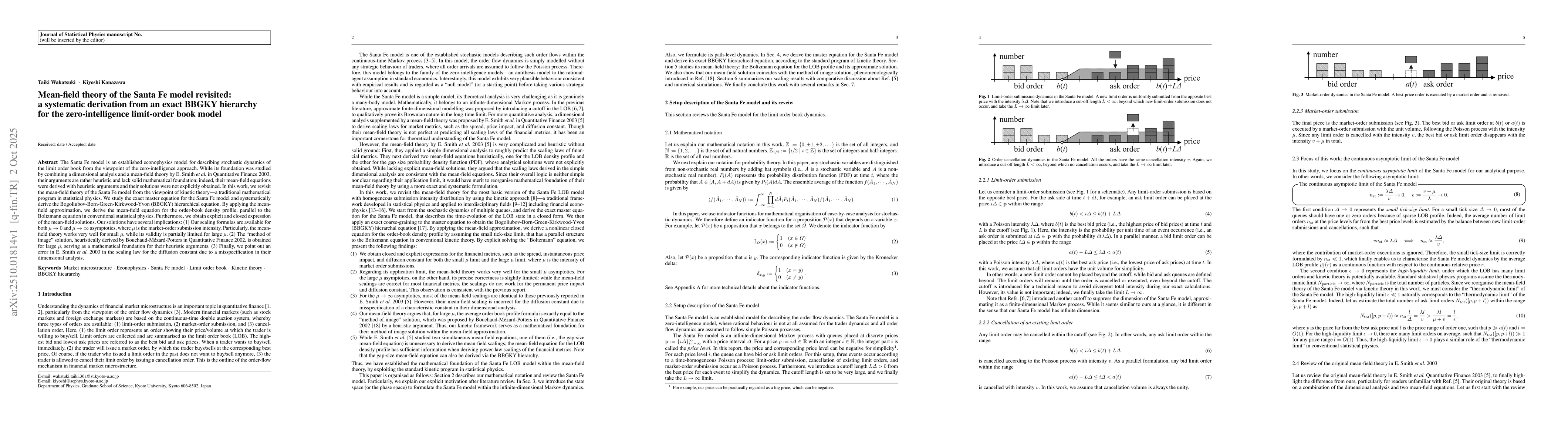

Mean-field theory of the Santa Fe model revisited: a systematic derivation from an exact BBGKY hierarchy for the zero-intelligence limit-order book model

The Santa Fe model is an established econophysics model for describing stochastic dynamics of the limit order book from the viewpoint of the zero-intelligence approach. While its foundation was studie...