Authors

Summary

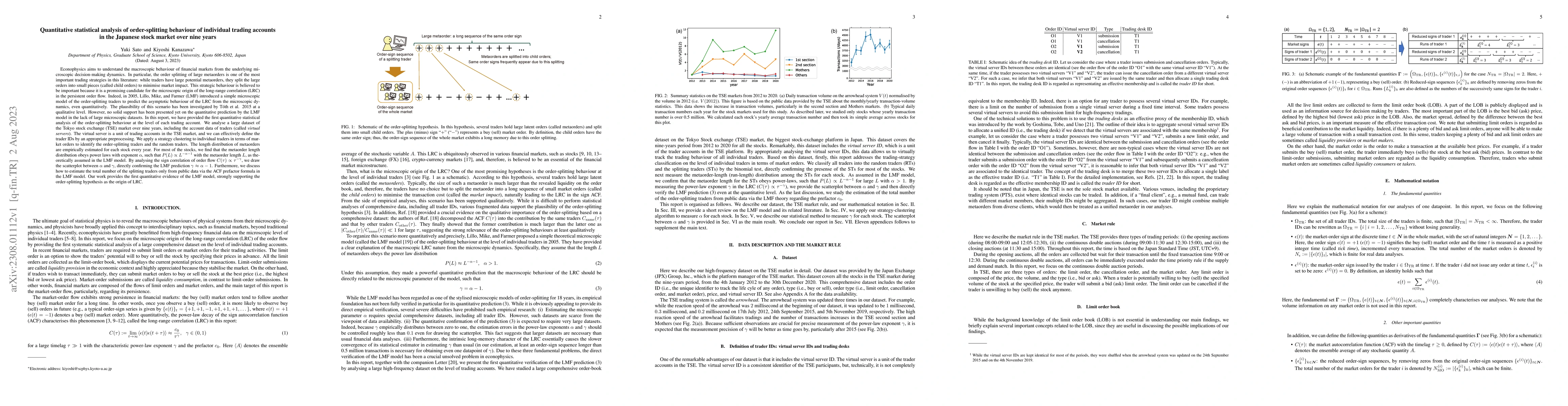

In this research, we focus on the order-splitting behavior. The order splitting is a trading strategy to execute their large potential metaorder into small pieces to reduce transaction cost. This strategic behavior is believed to be important because it is a promising candidate for the microscopic origin of the long-range correlation (LRC) in the persistent order flow. Indeed, in 2005, Lillo, Mike, and Farmer (LMF) introduced a microscopic model of the order-splitting traders to predict the asymptotic behavior of the LRC from the microscopic dynamics, even quantitatively. The plausibility of this scenario has been qualitatively investigated by Toth et al. 2015. However, no solid support has been presented yet on the quantitative prediction by the LMF model in the lack of large microscopic datasets. In this report, we have provided the first quantitative statistical analysis of the order-splitting behavior at the level of each trading account. We analyse a large dataset of the Tokyo stock exchange (TSE) market over nine years, including the account data of traders (called virtual servers). The virtual server is a unit of trading accounts in the TSE market, and we can effectively define the trader IDs by an appropriate preprocessing. We apply a strategy clustering to individual traders to identify the order-splitting traders and the random traders. For most of the stocks, we find that the metaorder length distribution obeys power laws with exponent $\alpha$, such that $P(L)\propto L^{-\alpha-1}$ with the metaorder length $L$. By analysing the sign correlation $C(\tau)\propto \tau^{-\gamma}$, we directly confirmed the LMF prediction $\gamma \approx \alpha-1$. Furthermore, we discuss how to estimate the total number of the splitting traders only from public data via the ACF prefactor formula in the LMF model. Our work provides the first quantitative evidence of the LMF model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)