Authors

Summary

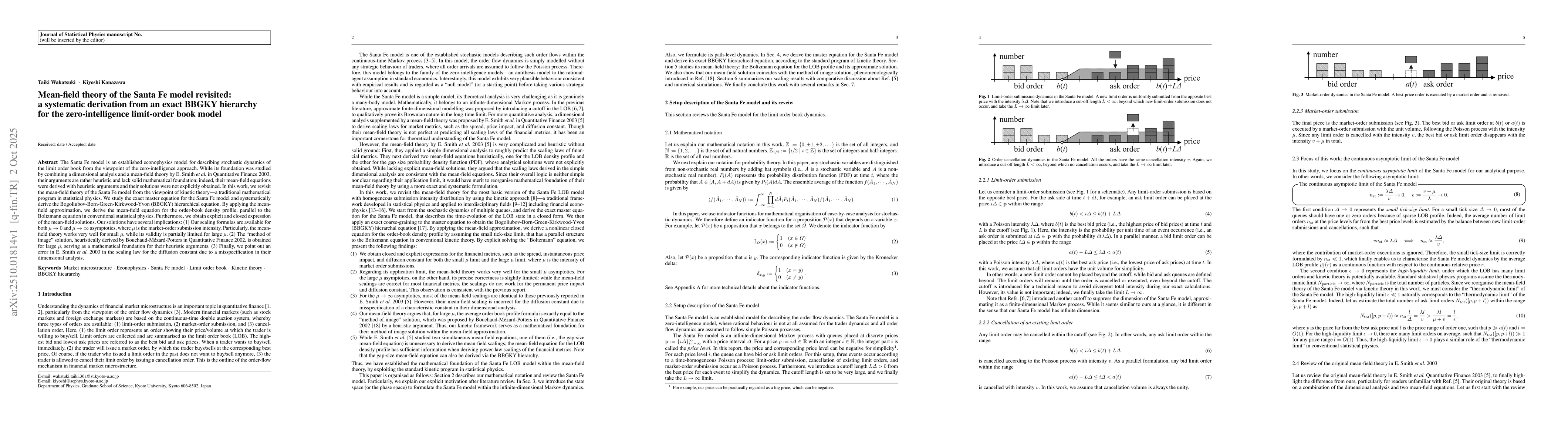

The Santa Fe model is an established econophysics model for describing stochastic dynamics of the limit order book from the viewpoint of the zero-intelligence approach. While its foundation was studied by combining a dimensional analysis and a mean-field theory by E. Smith et al. in Quantitative Finance 2003, their arguments are rather heuristic and lack solid mathematical foundation; indeed, their mean-field equations were derived with heuristic arguments and their solutions were not explicitly obtained. In this work, we revisit the mean-field theory of the Santa Fe model from the viewpoint of kinetic theory -- a traditional mathematical program in statistical physics. We study the exact master equation for the Santa Fe model and systematically derive the Bogoliubov-Born-Green-Kirkwood-Yvon (BBGKY) hierarchical equation. By applying the mean-field approximation, we derive the mean-field equation for the order-book density profile, parallel to the Boltzmann equation in conventional statistical physics. Furthermore, we obtain explicit and closed expression of the mean-field solutions. Our solutions have several implications: (1)Our scaling formulas are available for both $\mu\to 0$ and $\mu\to \infty$ asymptotics, where $\mu$ is the market-order submission intensity. Particularly, the mean-field theory works very well for small $\mu$, while its validity is partially limited for large $\mu$. (2)The ``method of image'' solution, heuristically derived by Bouchaud-M\'ezard-Potters in Quantitative Finance 2002, is obtained for large $\mu$, serving as a mathematical foundation for their heuristic arguments. (3)Finally, we point out an error in E. Smith et al. 2003 in the scaling law for the diffusion constant due to a misspecification in their dimensional analysis.

AI Key Findings

Generated Oct 03, 2025

Methodology

The research employs a combination of kinetic theory and mean-field approximations to model order-book dynamics, focusing on price gaps and market order impacts. It uses discrete price levels with small tick sizes and derives continuous equations through limiting processes.

Key Results

- Derivation of a continuous Boltzmann equation for order-book profiles

- Establishment of exact boundary conditions for small tick-size limits

- Calculation of financial metrics like spread and price impact using Kramers-Moyal coefficients

- Systematic derivation of gap-type mean-field equations for price gaps

Significance

This work provides a rigorous mathematical framework for understanding high-frequency trading dynamics, enabling more accurate modeling of market microstructure and improving predictions of price behavior under various market conditions.

Technical Contribution

Development of a kinetic theory framework for order-book dynamics, including derivation of mean-field equations for price gaps and financial metrics calculation using Kramers-Moyal coefficients.

Novelty

Introduces systematic derivation of gap-type mean-field equations through kinetic theory, combining discrete price-level analysis with continuous approximation techniques for financial market modeling.

Limitations

- Assumes small tick sizes and neglects complex order-book features like iceberg orders

- Relies on mean-field approximations which may not capture correlations in real markets

- Focus on simplified market models may limit applicability to real-world trading scenarios

Future Work

- Incorporate realistic order-book features like hidden orders and iceberg orders

- Extend to multi-asset markets and cross-market interactions

- Validate models with empirical data from real trading systems

- Explore machine learning approaches for improved market prediction

Paper Details

PDF Preview

Similar Papers

Found 4 papersExact solution to two-body financial dealer model: revisited from the viewpoint of kinetic theory

Kiyoshi Kanazawa, Misako Takayasu, Hideki Takayasu

Comments (0)