Authors

Summary

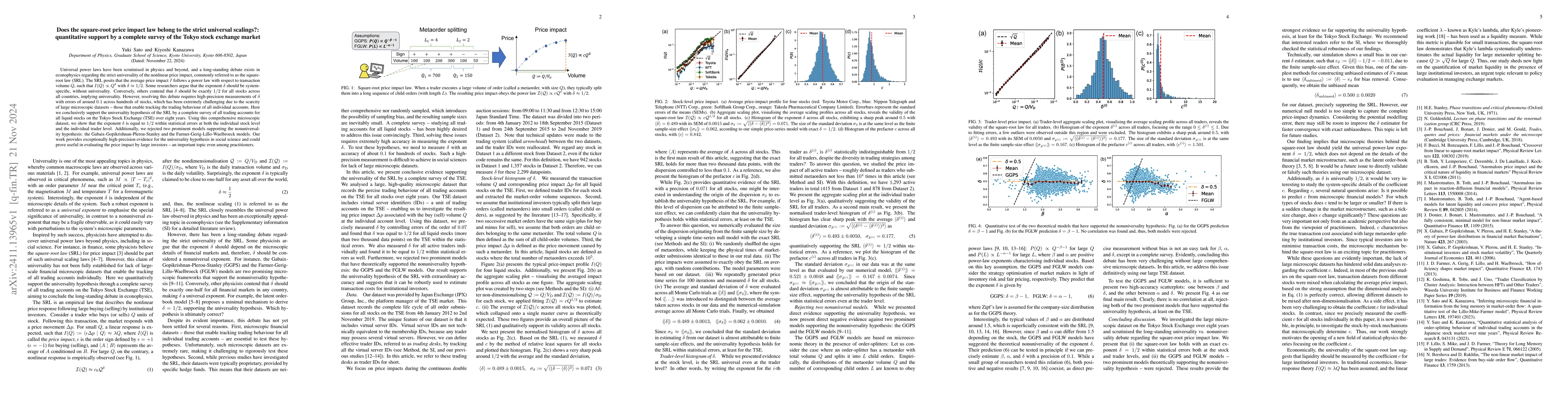

Universal power laws have been scrutinised in physics and beyond, and a long-standing debate exists in econophysics regarding the strict universality of the nonlinear price impact, commonly referred to as the square-root law (SRL). The SRL posits that the average price impact $I$ follows a power law with respect to transaction volume $Q$, such that $I(Q) \propto Q^{\delta}$ with $\delta \approx 1/2$. Some researchers argue that the exponent $\delta$ should be system-specific, without universality. Conversely, others contend that $\delta$ should be exactly $1/2$ for all stocks across all countries, implying universality. However, resolving this debate requires high-precision measurements of $\delta$ with errors of around $0.1$ across hundreds of stocks, which has been extremely challenging due to the scarcity of large microscopic datasets -- those that enable tracking the trading behaviour of all individual accounts. Here we conclusively support the universality hypothesis of the SRL by a complete survey of all trading accounts for all liquid stocks on the Tokyo Stock Exchange (TSE) over eight years. Using this comprehensive microscopic dataset, we show that the exponent $\delta$ is equal to $1/2$ within statistical errors at both the individual stock level and the individual trader level. Additionally, we rejected two prominent models supporting the nonuniversality hypothesis: the Gabaix-Gopikrishnan-Plerou-Stanley and the Farmer-Gerig-Lillo-Waelbroeck models. Our work provides exceptionally high-precision evidence for the universality hypothesis in social science and could prove useful in evaluating the price impact by large investors -- an important topic even among practitioners.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe "double" square-root law: Evidence for the mechanical origin of market impact using Tokyo Stock Exchange data

Jean-Philippe Bouchaud, Grégoire Loeper, Kiyoshi Kanazawa et al.

Exactly solvable model of the square-root price impact dynamics under the long-range market-order correlation

Yuki Sato, Kiyoshi Kanazawa

| Title | Authors | Year | Actions |

|---|

Comments (0)