Authors

Summary

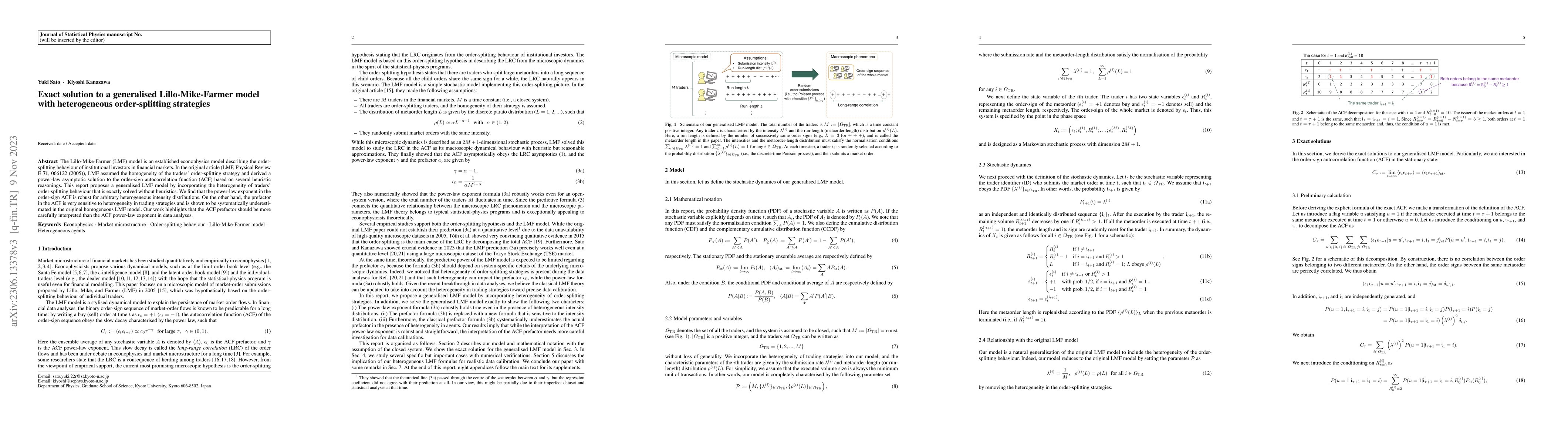

The Lillo-Mike-Farmer (LMF) model is an established econophysics model describing the order-splitting behaviour of institutional investors in financial markets. In the original article (LMF, Physical Review E 71, 066122 (2005)), LMF assumed the homogeneity of the traders' order-splitting strategy and derived a power-law asymptotic solution to the order-sign autocorrelation function (ACF) based on several heuristic reasonings. This report proposes a generalised LMF model by incorporating the heterogeneity of traders' order-splitting behaviour that is exactly solved without heuristics. We find that the power-law exponent in the order-sign ACF is robust for arbitrary heterogeneous intensity distributions. On the other hand, the prefactor in the ACF is very sensitive to heterogeneity in trading strategies and is shown to be systematically underestimated in the original homogeneous LMF model. Our work highlights that the ACF prefactor should be more carefully interpreted than the ACF power-law exponent in data analyses.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCan we infer microscopic financial information from the long memory in market-order flow?: a quantitative test of the Lillo-Mike-Farmer model

Yuki Sato, Kiyoshi Kanazawa

Exactly solvable model of the square-root price impact dynamics under the long-range market-order correlation

Yuki Sato, Kiyoshi Kanazawa

| Title | Authors | Year | Actions |

|---|

Comments (0)