Authors

Summary

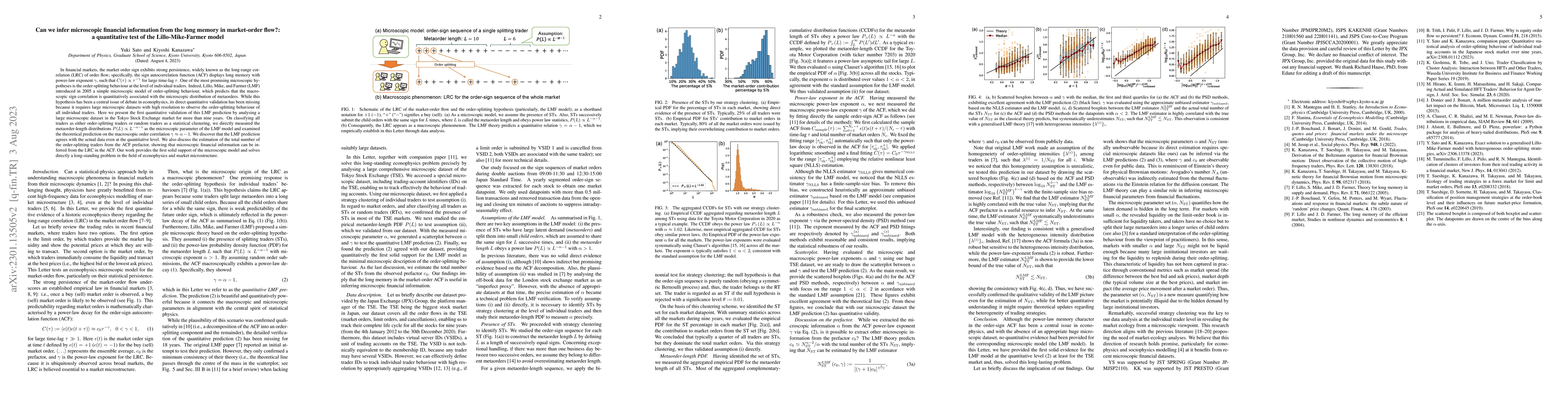

In financial markets, the market order sign exhibits strong persistence, widely known as the long-range correlation (LRC) of order flow; specifically, the sign correlation function displays long memory with power-law exponent $\gamma$, such that $C(\tau) \propto \tau^{-\gamma}$ for large time-lag $\tau$. One of the most promising microscopic hypotheses is the order-splitting behaviour at the level of individual traders. Indeed, Lillo, Mike, and Farmer (LMF) introduced in 2005 a simple microscopic model of order-splitting behaviour, which predicts that the macroscopic sign correlation is quantitatively associated with the microscopic distribution of metaorders. While this hypothesis has been a central issue of debate in econophysics, its direct quantitative validation has been missing because it requires large microscopic datasets with high resolution to observe the order-splitting behaviour of all individual traders. Here we present the first quantitative validation of this LFM prediction by analysing a large microscopic dataset in the Tokyo Stock Exchange market for more than nine years. On classifying all traders as either order-splitting traders or random traders as a statistical clustering, we directly measured the metaorder-length distributions $P(L)\propto L^{-\alpha-1}$ as the microscopic parameter of the LMF model and examined the theoretical prediction on the macroscopic order correlation: $\gamma \approx \alpha - 1$. We discover that the LMF prediction agrees with the actual data even at the quantitative level. Our work provides the first solid support of the microscopic model and solves directly a long-standing problem in the field of econophysics and market microstructure.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersExact solution to a generalised Lillo-Mike-Farmer model with heterogeneous order-splitting strategies

Yuki Sato, Kiyoshi Kanazawa

Exactly solvable model of the square-root price impact dynamics under the long-range market-order correlation

Yuki Sato, Kiyoshi Kanazawa

| Title | Authors | Year | Actions |

|---|

Comments (0)