Summary

Machine learning algorithms dedicated to financial time series forecasting have gained a lot of interest. But choosing between several algorithms can be challenging, as their estimation accuracy may be unstable over time. Online aggregation of experts combine the forecasts of a finite set of models in a single approach without making any assumption about the models. In this paper, a Bernstein Online Aggregation (BOA) procedure is applied to the construction of long-short strategies built from individual stock return forecasts coming from different machine learning models. The online mixture of experts leads to attractive portfolio performances even in environments characterised by non-stationarity. The aggregation outperforms individual algorithms, offering a higher portfolio Sharpe Ratio, lower shortfall, with a similar turnover. Extensions to expert and aggregation specialisations are also proposed to improve the overall mixture on a family of portfolio evaluation metrics.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

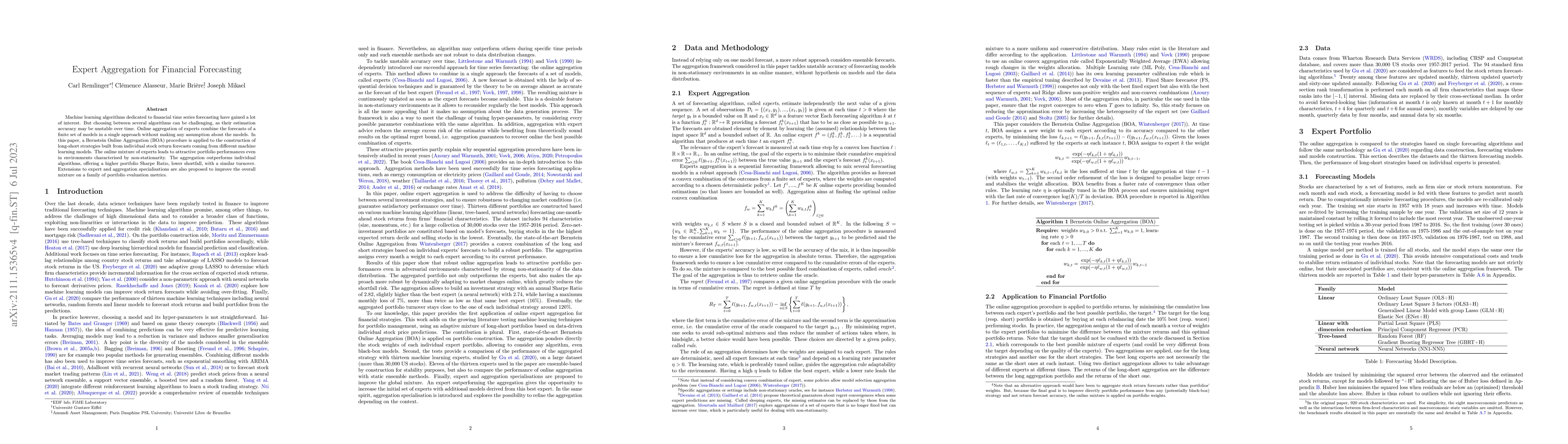

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMEXA: Towards General Multimodal Reasoning with Dynamic Multi-Expert Aggregation

Yue Zhang, Mohit Bansal, Ziyang Wang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)