Summary

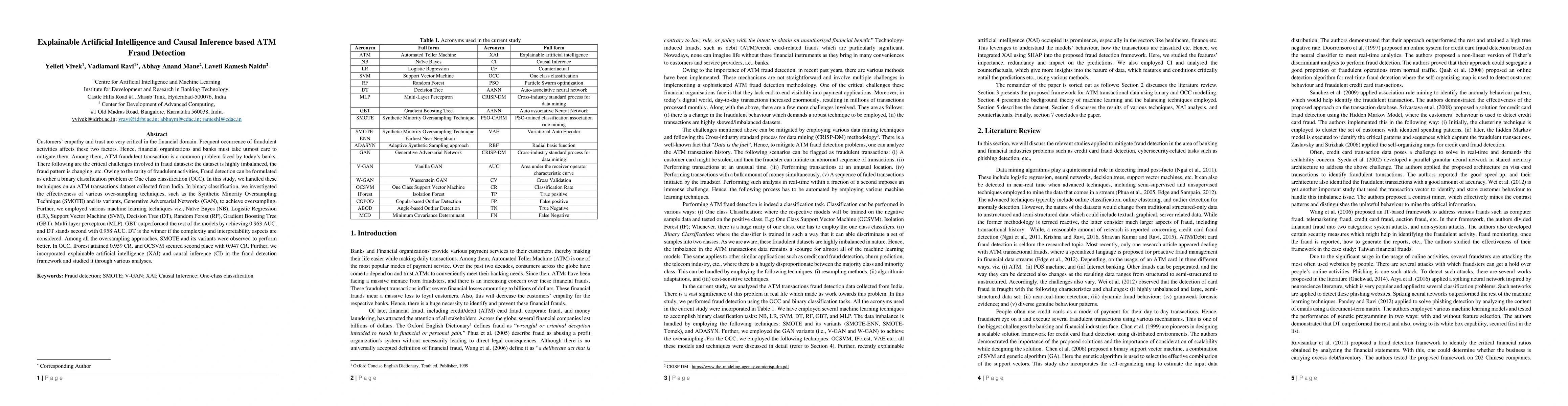

Gaining the trust of customers and providing them empathy are very critical in the financial domain. Frequent occurrence of fraudulent activities affects these two factors. Hence, financial organizations and banks must take utmost care to mitigate them. Among them, ATM fraudulent transaction is a common problem faced by banks. There following are the critical challenges involved in fraud datasets: the dataset is highly imbalanced, the fraud pattern is changing, etc. Owing to the rarity of fraudulent activities, Fraud detection can be formulated as either a binary classification problem or One class classification (OCC). In this study, we handled these techniques on an ATM transactions dataset collected from India. In binary classification, we investigated the effectiveness of various over-sampling techniques, such as the Synthetic Minority Oversampling Technique (SMOTE) and its variants, Generative Adversarial Networks (GAN), to achieve oversampling. Further, we employed various machine learning techniques viz., Naive Bayes (NB), Logistic Regression (LR), Support Vector Machine (SVM), Decision Tree (DT), Random Forest (RF), Gradient Boosting Tree (GBT), Multi-layer perceptron (MLP). GBT outperformed the rest of the models by achieving 0.963 AUC, and DT stands second with 0.958 AUC. DT is the winner if the complexity and interpretability aspects are considered. Among all the oversampling approaches, SMOTE and its variants were observed to perform better. In OCC, IForest attained 0.959 CR, and OCSVM secured second place with 0.947 CR. Further, we incorporated explainable artificial intelligence (XAI) and causal inference (CI) in the fraud detection framework and studied it through various analyses.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersATM Fraud Detection using Streaming Data Analytics

Yelleti Vivek, Vadlamani Ravi, Abhay Anand Mane et al.

SEFraud: Graph-based Self-Explainable Fraud Detection via Interpretative Mask Learning

Tianmeng Yang, Jiahao Meng, Min Zhou et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)