Summary

We consider an asset whose risk-neutral dynamics are described by a general class of local-stochastic volatility models and derive a family of asymptotic expansions for European-style option prices and implied volatilities. Our implied volatility expansions are explicit; they do not require any special functions nor do they require numerical integration. To illustrate the accuracy and versatility of our method, we implement it under five different model dynamics: CEV local volatility, quadratic local volatility, Heston stochastic volatility, $3/2$ stochastic volatility, and SABR local-stochastic volatility.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

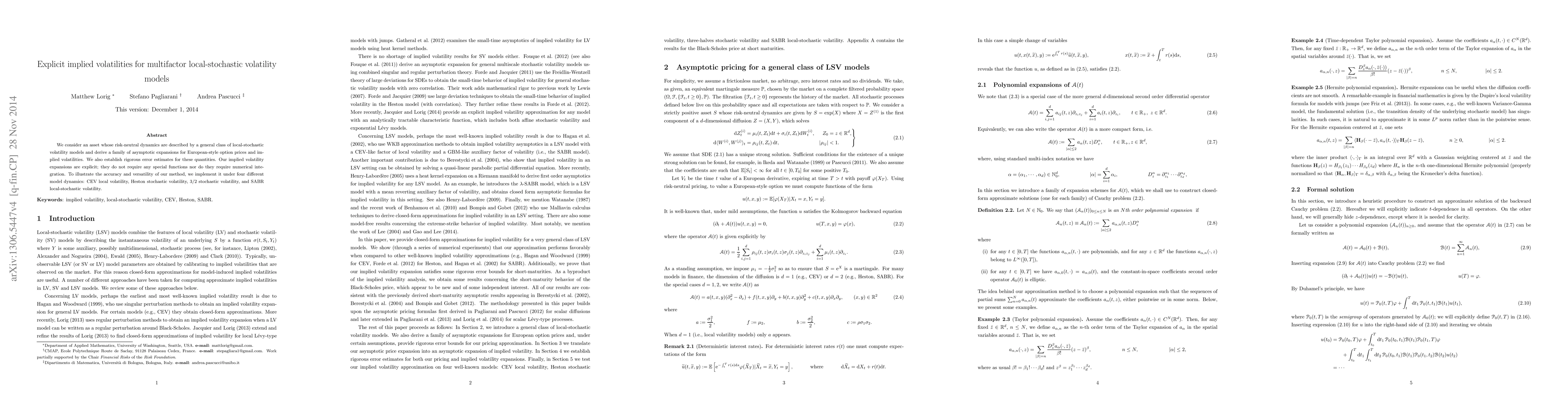

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersExplicit Caplet Implied Volatilities for Quadratic Term-Structure Models

Matthew Lorig, Natchanon Suaysom

| Title | Authors | Year | Actions |

|---|

Comments (0)