Summary

We consider implied volatilities in asset pricing models, where the discounted underlying is a strict local martingale under the pricing measure. Our main result gives an asymptotic expansion of the right wing of the implied volatility smile and shows that the strict local martingale property can be determined from this expansion. This result complements the well-known asymptotic results of Lee and Benaim-Friz, which apply only to true martingales. This also shows that `price bubbles' in the sense of strict local martingale behaviour can in principle be detected by an analysis of implied volatility. Finally we relate our results to left-wing expansions of implied volatilities in models with mass at zero by a duality method based on an absolutely continuous measure change.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

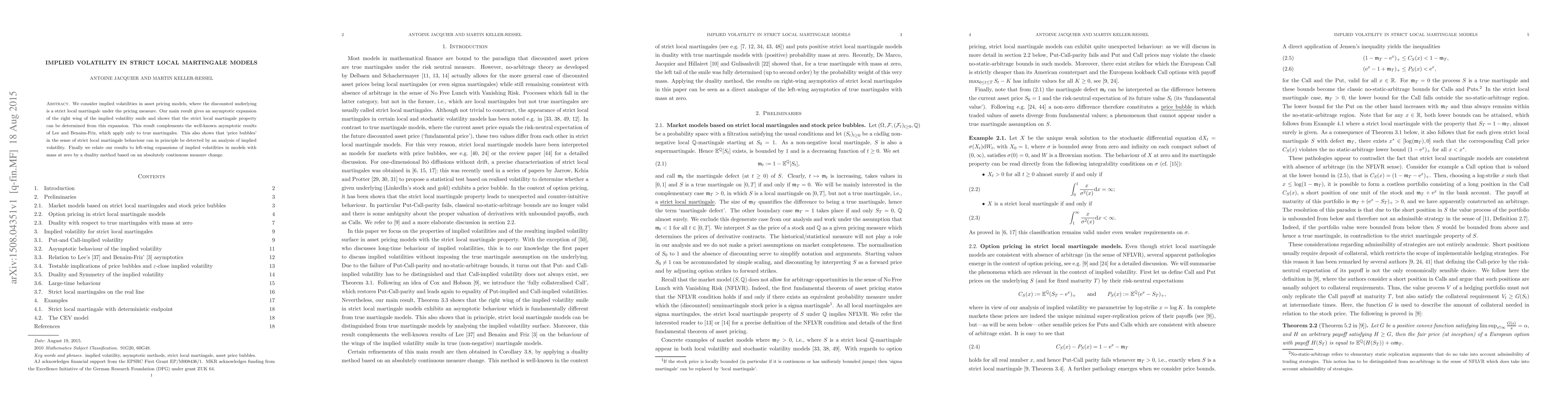

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)