Summary

For any strictly positive martingale $S = \exp(X)$ for which $X$ has a characteristic function, we provide an expansion for the implied volatility. This expansion is explicit in the sense that it involves no integrals, but only polynomials in the log strike. We illustrate the versatility of our expansion by computing the approximate implied volatility smile in three well-known martingale models: one finite activity exponential L\'evy model (Merton), one infinite activity exponential L\'evy model (Variance Gamma), and one stochastic volatility model (Heston). Finally, we illustrate how our expansion can be used to perform a model-free calibration of the empirically observed implied volatility surface.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

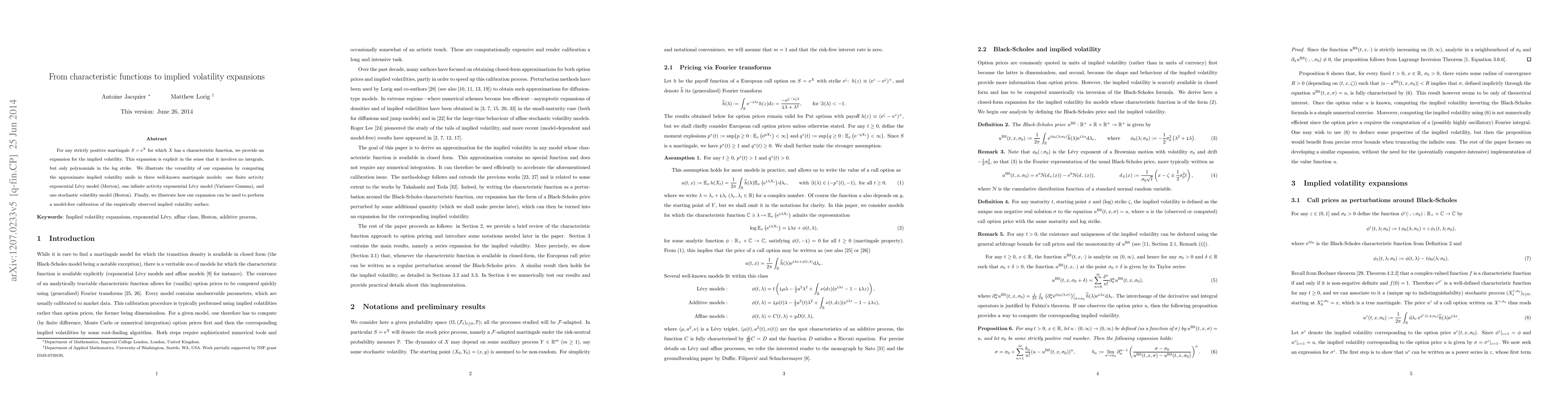

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)