Summary

We derive an explicit analytical approximation for the local volatility function in the Cheyette interest rate model, extending the classical Dupire framework to fixed-income markets. The result expresses local volatility in terms of time and strike derivatives of the Bachelier implied variance, naturally generalizes to multi-factor Cheyette models, and provides a practical tool for model calibration.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

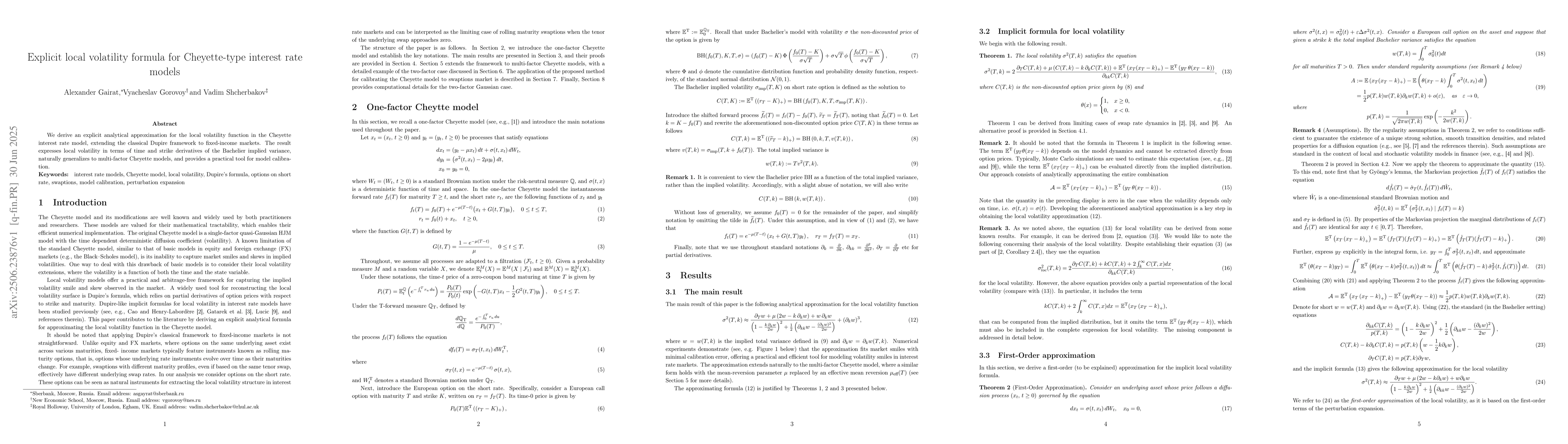

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersExtensions of Dupire Formula: Stochastic Interest Rates and Stochastic Local Volatility

Orcan Ogetbil, Bernhard Hientzsch

Calibration of Local Volatility Models with Stochastic Interest Rates using Optimal Transport

Gregoire Loeper, Jan Obloj, Benjamin Joseph

No citations found for this paper.

Comments (0)