Authors

Summary

While research of reinforcement learning applied to financial markets predominantly concentrates on finding optimal behaviours, it is worth to realize that the reinforcement learning returns $G_t$ and state value functions themselves are of interest and play a pivotal role in the evaluation of assets. Instead of focussing on the more complex task of finding optimal decision rules, this paper studies and applies the power of distributional state value functions in the context of financial market valuation and machine learning based trading algorithms. Accurate and trustworthy estimates of the distributions of $G_t$ provide a competitive edge leading to better informed decisions and more optimal behaviour. Herein, ideas from predictive knowledge and deep reinforcement learning are combined to introduce a novel family of models called CDG-Model, resulting in a highly flexible framework and intuitive approach with minimal assumptions regarding underlying distributions. The models allow seamless integration of typical financial modelling pitfalls like transaction costs, slippage and other possible costs or benefits into the model calculation. They can be applied to any kind of trading strategy or asset class. The frameworks introduced provide concrete business value through their potential in market valuation of single assets and portfolios, in the comparison of strategies as well as in the improvement of market timing. They can positively impact the performance and enhance the learning process of existing or new trading algorithms. They are of interest from a scientific point-of-view and open up multiple areas of future research. Initial implementations and tests were performed on real market data. While the results are promising, applying a robust statistical framework to evaluate the models in general remains a challenge and further investigations are needed.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

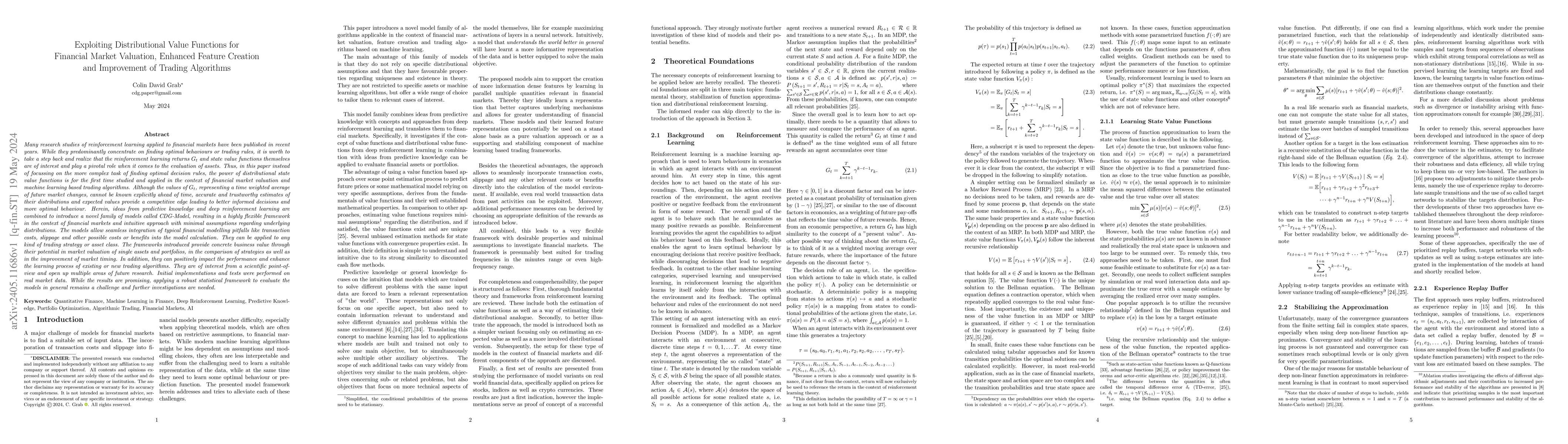

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersExploiting Unfair Advantages: Investigating Opportunistic Trading in the NFT Market

Dipanjan Das, Christopher Kruegel, Giovanni Vigna et al.

No citations found for this paper.

Comments (0)