Summary

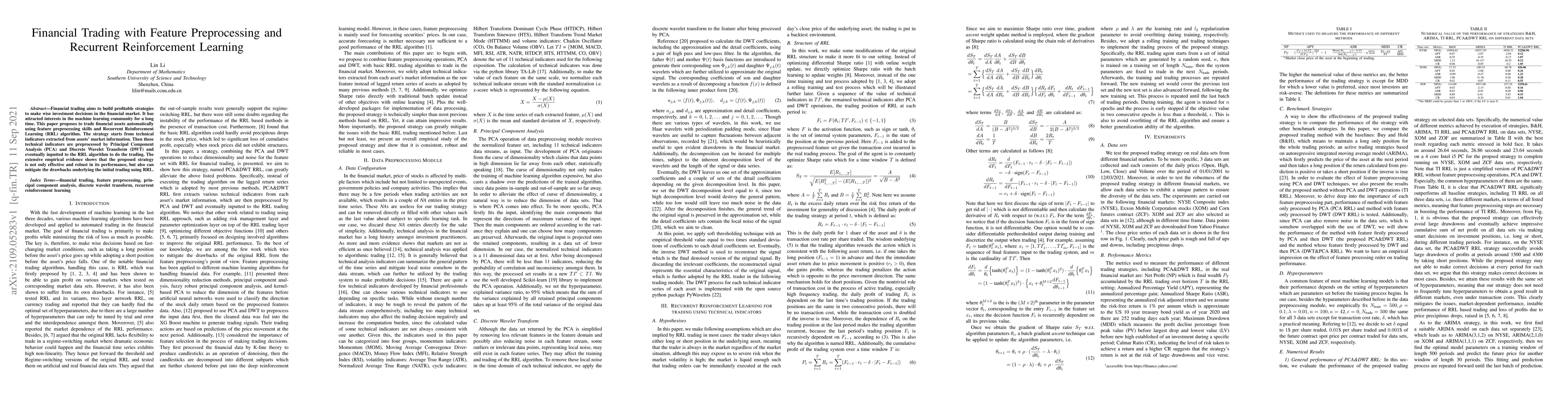

Financial trading aims to build profitable strategies to make wise investment decisions in the financial market. It has attracted interests in the machine learning community for a long time. This paper proposes to trade financial assets automatically using feature preprocessing skills and Recurrent Reinforcement Learning (RRL) algorithm. The strategy starts from technical indicators extracted from assets' market information. Then these technical indicators are preprocessed by Principal Component Analysis (PCA) and Discrete Wavelet Transform (DWT) and eventually inputted to the RRL algorithm to do the trading. The extensive empirical evidence shows that the proposed strategy is not only effective and robust in its performance, but also can mitigate the drawbacks underlying the initial trading using RRL.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)