Authors

Summary

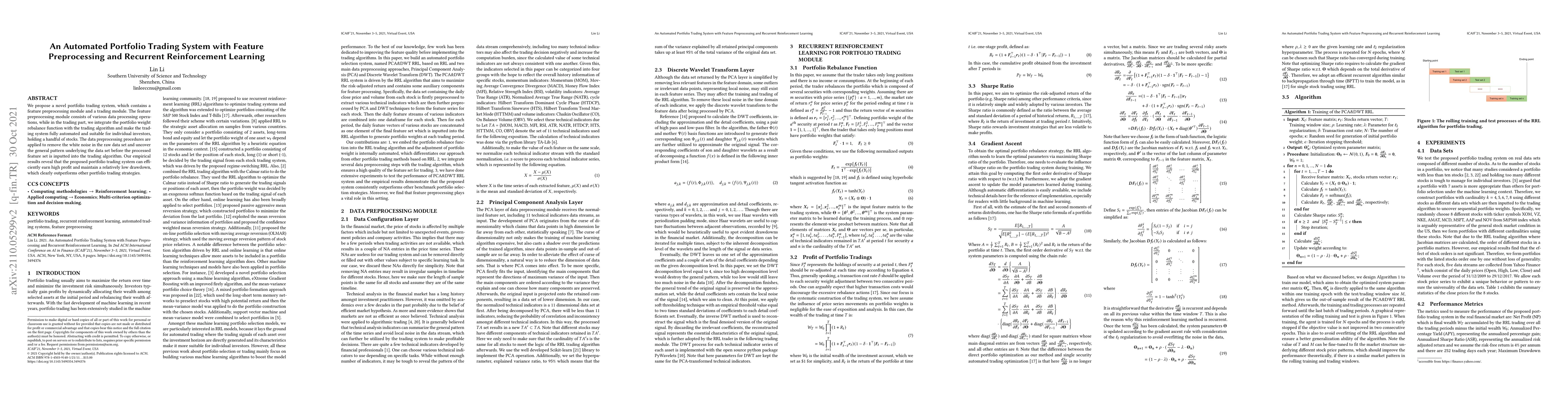

We propose a novel portfolio trading system, which contains a feature preprocessing module and a trading module. The feature preprocessing module consists of various data processing operations, while in the trading part, we integrate the portfolio weight rebalance function with the trading algorithm and make the trading system fully automated and suitable for individual investors, holding a handful of stocks. The data preprocessing procedures are applied to remove the white noise in the raw data set and uncover the general pattern underlying the data set before the processed feature set is inputted into the trading algorithm. Our empirical results reveal that the proposed portfolio trading system can efficiently earn high profit and maintain a relatively low drawdown, which clearly outperforms other portfolio trading strategies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAn Ensemble Method of Deep Reinforcement Learning for Automated Cryptocurrency Trading

Diego Klabjan, Shuyang Wang

A Framework for Empowering Reinforcement Learning Agents with Causal Analysis: Enhancing Automated Cryptocurrency Trading

Dhananjay Thiruvady, Asef Nazari, Rasoul Amirzadeh et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)