Authors

Summary

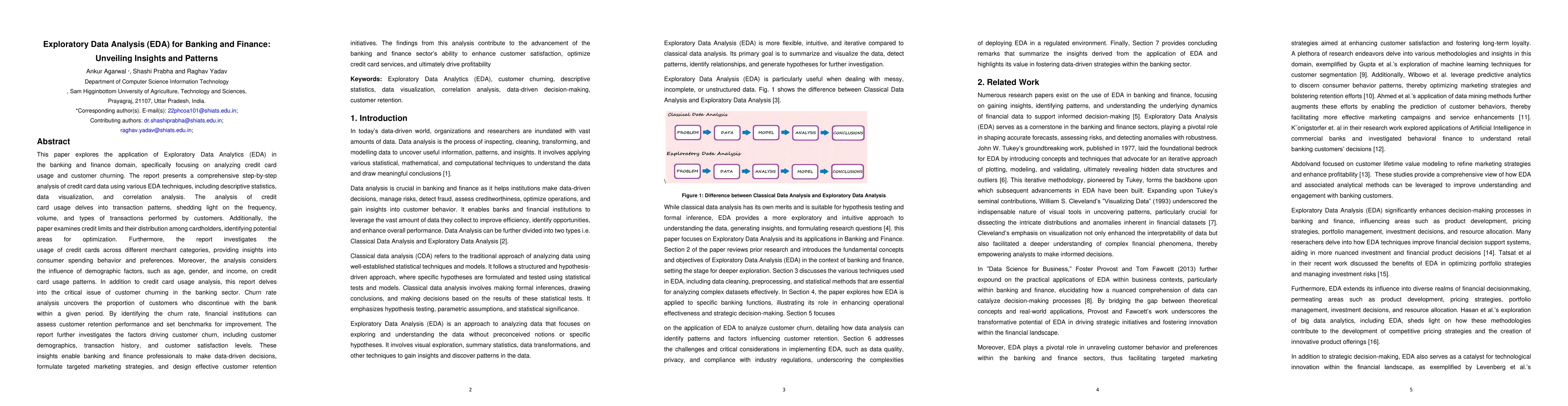

This paper explores the application of Exploratory Data Analytics (EDA) in the banking and finance domain, focusing on credit card usage and customer churning. It presents a step-by-step analysis using EDA techniques such as descriptive statistics, data visualization, and correlation analysis. The study examines transaction patterns, credit limits, and usage across merchant categories, providing insights into consumer behavior. It also considers demographic factors like age, gender, and income on usage patterns. Additionally, the report addresses customer churning, analyzing churn rates and factors such as demographics, transaction history, and satisfaction levels. These insights help banking professionals make data-driven decisions, improve marketing strategies, and enhance customer retention, ultimately contributing to profitability.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)