Summary

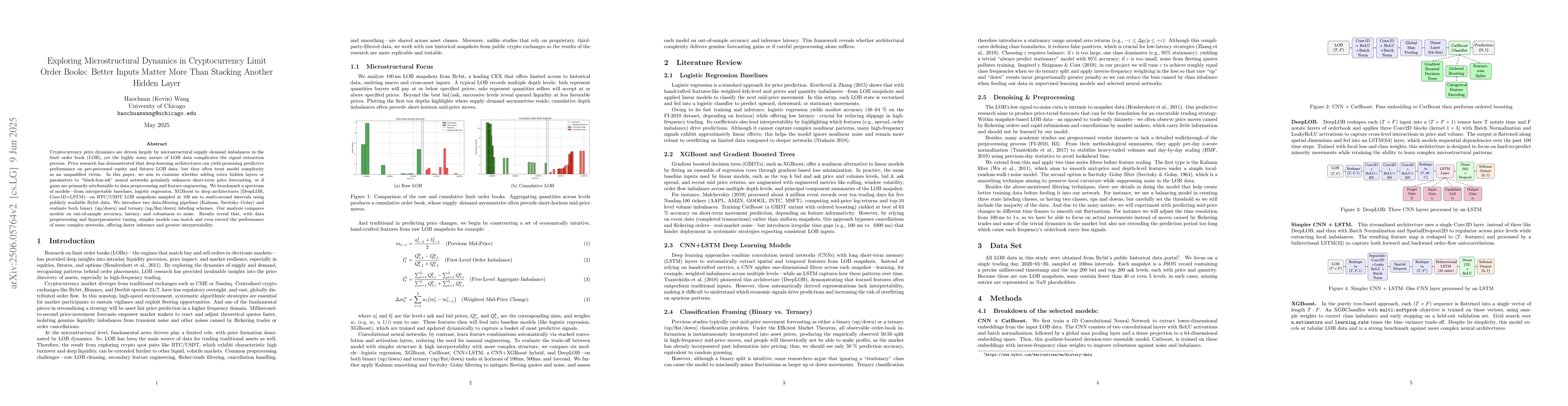

Cryptocurrency price dynamics are driven largely by microstructural supply demand imbalances in the limit order book (LOB), yet the highly noisy nature of LOB data complicates the signal extraction process. Prior research has demonstrated that deep-learning architectures can yield promising predictive performance on pre-processed equity and futures LOB data, but they often treat model complexity as an unqualified virtue. In this paper, we aim to examine whether adding extra hidden layers or parameters to "blackbox ish" neural networks genuinely enhances short term price forecasting, or if gains are primarily attributable to data preprocessing and feature engineering. We benchmark a spectrum of models from interpretable baselines, logistic regression, XGBoost to deep architectures (DeepLOB, Conv1D+LSTM) on BTC/USDT LOB snapshots sampled at 100 ms to multi second intervals using publicly available Bybit data. We introduce two data filtering pipelines (Kalman, Savitzky Golay) and evaluate both binary (up/down) and ternary (up/flat/down) labeling schemes. Our analysis compares models on out of sample accuracy, latency, and robustness to noise. Results reveal that, with data preprocessing and hyperparameter tuning, simpler models can match and even exceed the performance of more complex networks, offering faster inference and greater interpretability.

AI Key Findings

Generated Jun 09, 2025

Methodology

The research employs a benchmarking approach, comparing a spectrum of models, from interpretable baselines like logistic regression and XGBoost to deep architectures (DeepLOB, Conv1D+LSTM), on BTC/USDT limit order book snapshots at various intervals. Two data filtering pipelines (Kalman, Savitzky Golay) are introduced, and models are evaluated based on out-of-sample accuracy, latency, and robustness to noise under binary and ternary labeling schemes.

Key Results

- Simpler models with proper data preprocessing and hyperparameter tuning can match or exceed the performance of more complex networks.

- Gains in predictive performance are largely attributable to data preprocessing and feature engineering rather than increased model complexity.

- Simpler models offer faster inference and greater interpretability compared to complex networks.

Significance

This research is significant as it challenges the assumption that model complexity inherently leads to better predictive performance in financial markets, particularly for cryptocurrency limit order books, which are notoriously noisy.

Technical Contribution

The paper presents comparative evaluations of various machine learning models for predicting cryptocurrency price movements from limit order book data, highlighting the importance of data preprocessing and feature engineering over excessive model complexity.

Novelty

This work distinguishes itself by questioning the common belief that 'black box' deep learning models with increased complexity inherently lead to better performance, emphasizing instead the critical role of data preprocessing and feature engineering in short-term price forecasting for cryptocurrencies.

Limitations

- The study is limited to BTC/USDT pairs on the Bybit exchange, which may not generalize to other cryptocurrencies or exchanges.

- While the research emphasizes simpler models, it does not explore the potential of hybrid models combining simple and complex architectures.

Future Work

- Investigate the performance of hybrid models that blend simple and complex architectures for improved predictive accuracy.

- Extend the analysis to other cryptocurrency pairs and exchanges to validate the findings' generalizability.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)