Summary

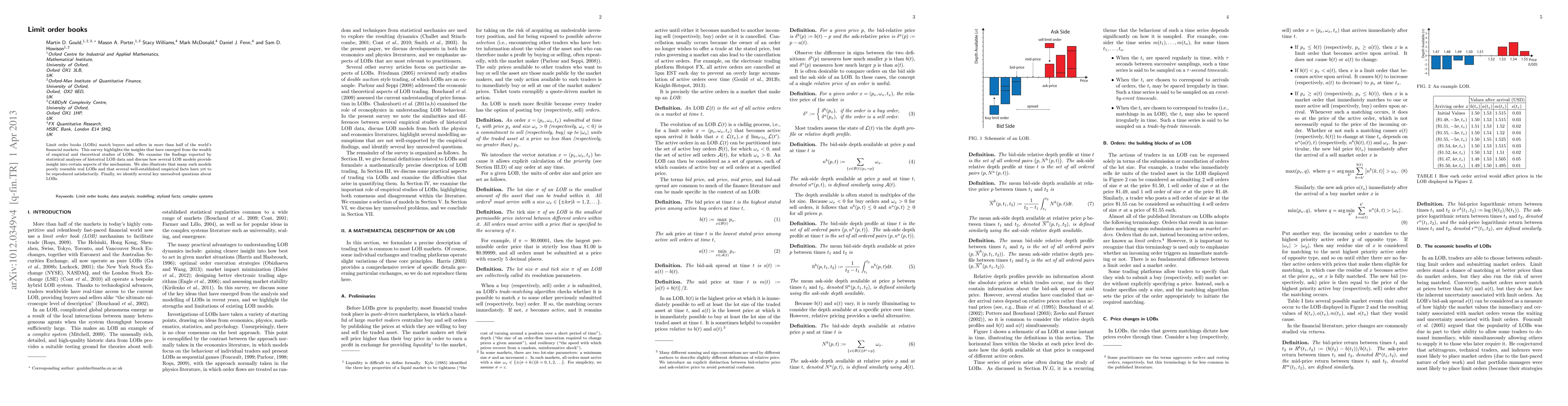

Limit order books (LOBs) match buyers and sellers in more than half of the world's financial markets. This survey highlights the insights that have emerged from the wealth of empirical and theoretical studies of LOBs. We examine the findings reported by statistical analyses of historical LOB data and discuss how several LOB models provide insight into certain aspects of the mechanism. We also illustrate that many such models poorly resemble real LOBs and that several well-established empirical facts have yet to be reproduced satisfactorily. Finally, we identify several key unresolved questions about LOBs.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)