Authors

Summary

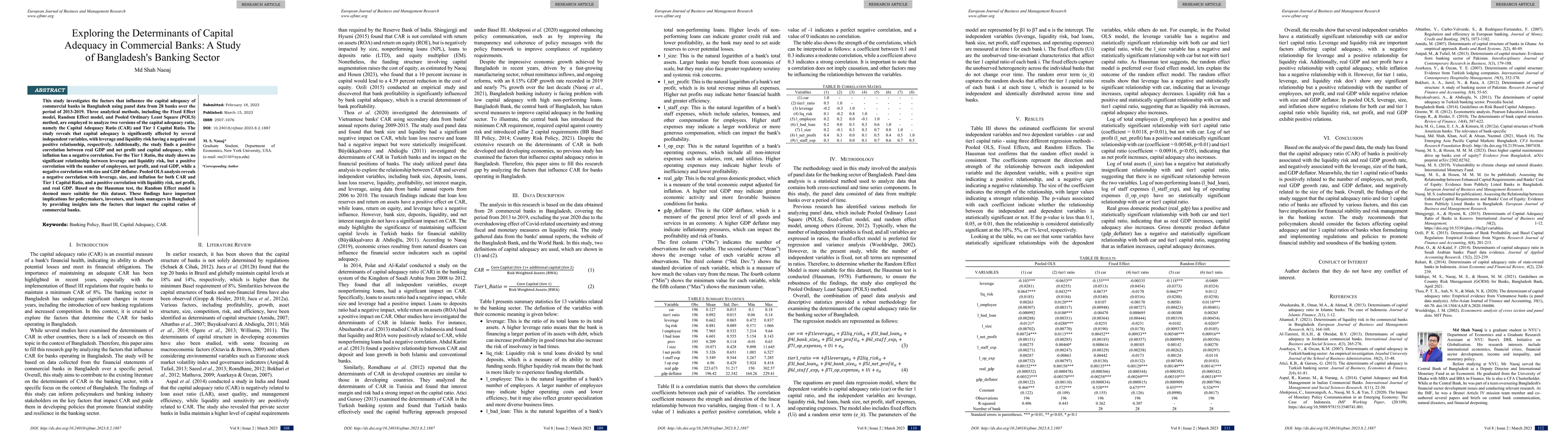

This study investigates the factors that influence the capital adequacy of commercial banks in Bangladesh using panel data from 28 banks over the period of 2013-2019. Three analytical methods, including the Fixed Effect model, Random Effect model, and Pooled Ordinary Least Square (POLS) method, are employed to analyze two versions of the capital adequacy ratio, namely the Capital Adequacy Ratio (CAR) and Tier 1 Capital Ratio. The study reveals that capital adequacy is significantly affected by several independent variables, with leverage and liquidity risk having a negative and positive relationship, respectively. Additionally, the study finds a positive correlation between real GDP and net profit and capital adequacy, while inflation has a negative correlation. For the Tier 1 Ratio, the study shows no significant relationship betweenleverage and liquidity risk, but a positive correlation with the number of employees, net profit, and real GDP, while a negative correlation with size and GDP deflator. Pooled OLS analysis reveals a negative correlation with leverage, size, and inflation for both CAR and Tier 1 Capital Ratio, and a positive correlation with liquidity risk, net profit, and real GDP. Based on the Hausman test, the Random Effect model is deemed moresuitable for this dataset. These findings have important implications for policymakers, investors, and bank managers in Bangladesh by providing insights into the factors that impact the capital ratios of commercial banks.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCapital Structure Dynamics and Financial Performance in Indian Banks (An Analysis of Mergers and Acquisitions)

Kurada T S S Satyanarayana, Addada Narasimha Rao, Kumpatla jaya surya

| Title | Authors | Year | Actions |

|---|

Comments (0)