Authors

Summary

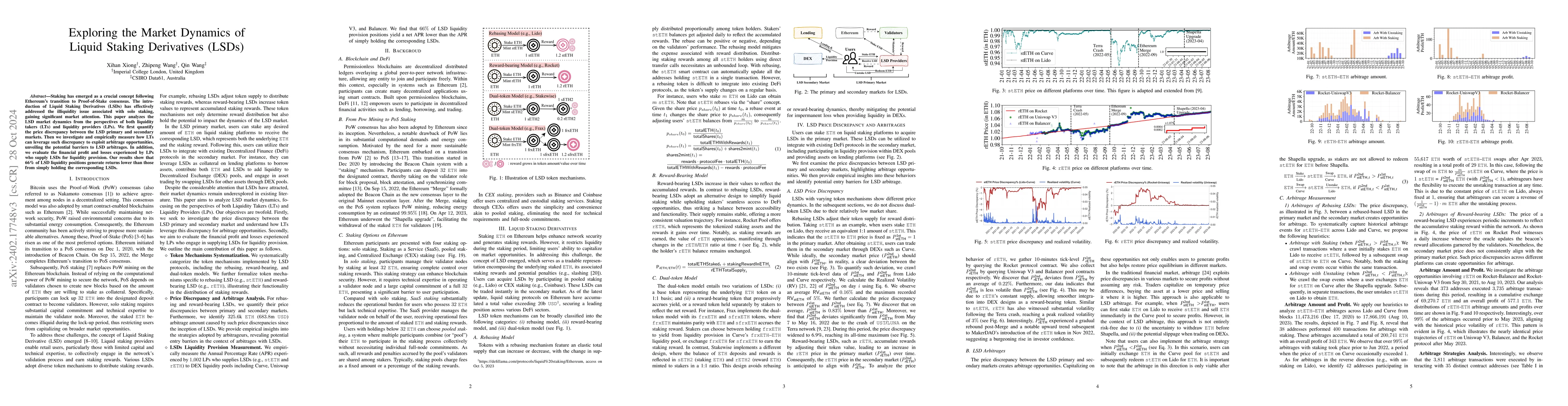

Staking has emerged as a crucial concept following Ethereum's transition to Proof-of-Stake consensus. The introduction of Liquid Staking Derivatives (LSDs) has effectively addressed the illiquidity issue associated with solo staking, gaining significant market attention. This paper analyzes the LSD market dynamics from the perspectives of both liquidity takers (LTs) and liquidity providers (LPs). We first quantify the price discrepancy between the LSD primary and secondary markets. Then we investigate and empirically measure how LTs can leverage such discrepancy to exploit arbitrage opportunities, unveiling the potential barriers to LSD arbitrages. In addition, we evaluate the financial profit and losses experienced by LPs who supply LSDs for liquidity provision. Our results show that 66% of LSD liquidity positions generate returns lower than those from simply holding the corresponding LSDs.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLeverage Staking with Liquid Staking Derivatives (LSDs): Opportunities and Risks

Xi Chen, Xihan Xiong, Zhipeng Wang et al.

Liquid Staking Tokens in Automated Market Makers

Krzysztof Gogol, Johnnatan Messias, Claudio Tessone et al.

Towards a Formal Framework of the Ethereum Staking Market

Nicolas Oderbolz, Matthias Hafner, Juan Beccuti et al.

SoK: Liquid Staking Tokens (LSTs)

Krzysztof Gogol, Claudio Tessone, Benjamin Kraner et al.

No citations found for this paper.

Comments (0)