Summary

In the Proof of Stake (PoS) Ethereum ecosystem, users can stake ETH on Lido to receive stETH, a Liquid Staking Derivative (LSD) that represents staked ETH and accrues staking rewards. LSDs improve the liquidity of staked assets by facilitating their use in secondary markets, such as for collateralized borrowing on Aave or asset exchanges on Curve. The composability of Lido, Aave, and Curve enables an emerging strategy known as leverage staking, where users supply stETH as collateral on Aave to borrow ETH and then acquire more stETH. This can be done directly by initially staking ETH on Lido or indirectly by swapping ETH for stETH on Curve. While this iterative process enhances financial returns, it also introduces potential risks. This paper explores the opportunities and risks of leverage staking. We establish a formal framework for leverage staking with stETH and identify 442 such positions on Ethereum over 963 days. These positions represent a total volume of 537,123 ETH (877m USD). Our data reveal that the majority (81.7%) of leverage staking positions achieved an Annual Percentage Rate (APR) higher than that of conventional staking on Lido. Despite the high returns, we also recognize the risks of leverage staking. From the Terra crash incident, we understand that token devaluation can greatly impact the market. Therefore, we conduct stress tests under extreme conditions, particularly during stETH devaluations, to thoroughly evaluate the associated risks. Our simulations indicate that leverage staking can exacerbate the risk of cascading liquidations by introducing additional selling pressures from liquidation and deleveraging activities. Moreover, this strategy poses broader systemic risks as it undermines the stability of ordinary positions by intensifying their liquidations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

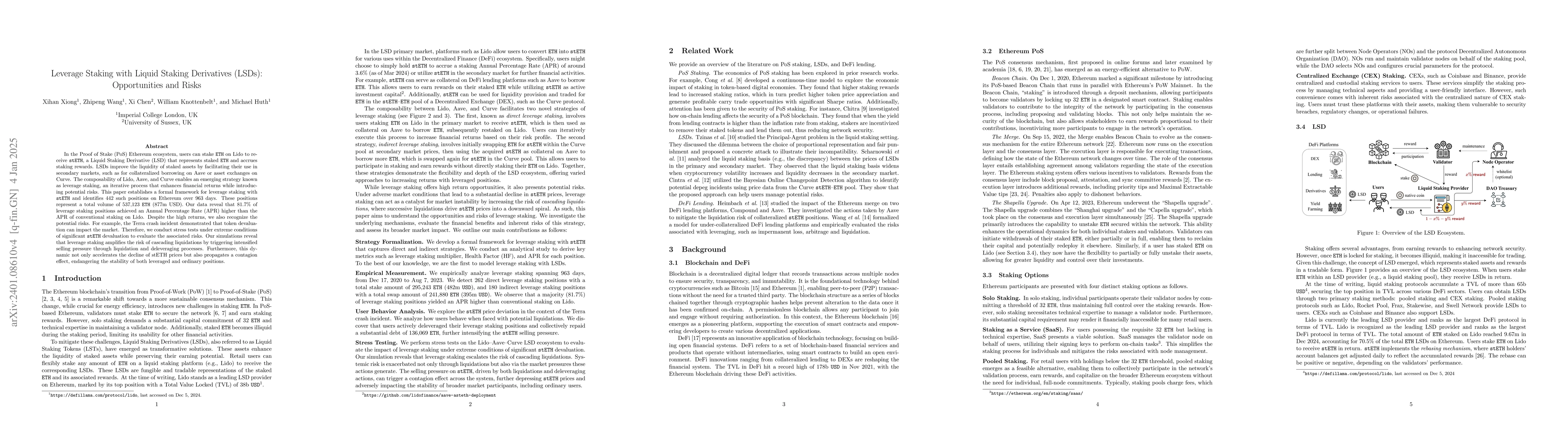

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersExploring the Market Dynamics of Liquid Staking Derivatives (LSDs)

Xihan Xiong, Zhipeng Wang, Qin Wang

SoK: Liquid Staking Tokens (LSTs)

Krzysztof Gogol, Claudio Tessone, Benjamin Kraner et al.

Empirical and Theoretical Analysis of Liquid Staking Protocols

Burkhard Stiller, Krzysztof Gogol, Claudio Tessone et al.

Liquid Staking Tokens in Automated Market Makers

Krzysztof Gogol, Johnnatan Messias, Claudio Tessone et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)