Summary

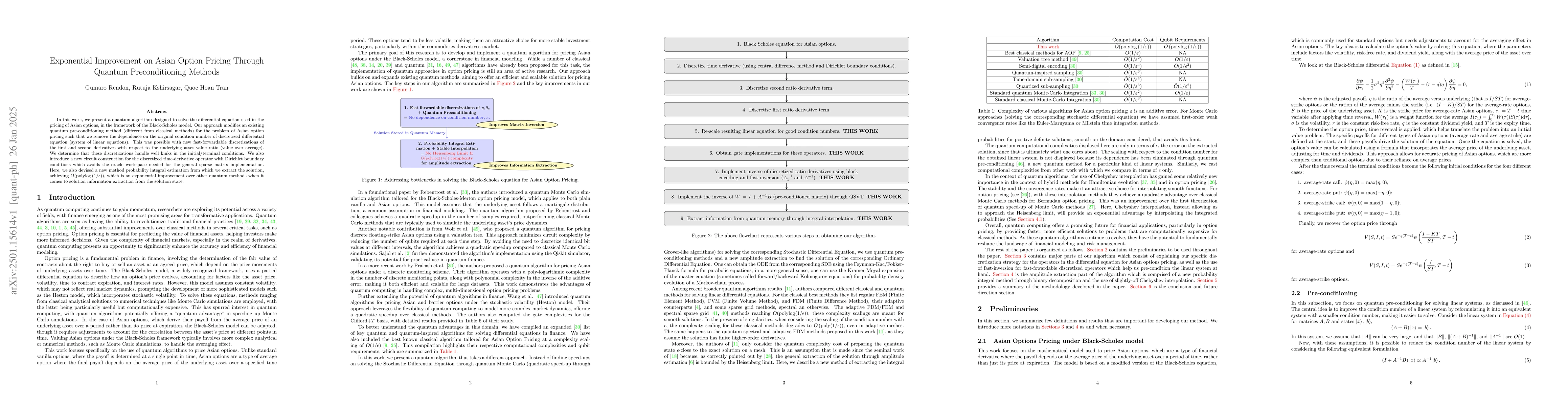

In this work, we present a quantum algorithm designed to solve the differential equation used in the pricing of Asian options, in the framework of the Black-Scholes model. Our approach modifies an existing quantum pre-conditioning method (different from classical methods) for the problem of Asian option pricing such that we remove the dependence on the original condition number of discretized differential equation (system of linear equations). This was possible with new fast-forwardable discretizations of the first and second derivatives with respect to the underlying asset value ratio (value over average). We determine that these discretizations handle well kinks in the initial/terminal conditions. We also introduce a new circuit construction for the discretized time-derivative operator with Dirichlet boundary conditions which avoids the oracle workspace needed for the general sparse matrix implementation. Here, we also devised a new method probability integral estimation from which we extract the solution, achieving $\tilde{O}({\rm polylog}\left(1/\epsilon)\right)$, which is an exponential improvement over other quantum methods when it comes to solution information extraction from the solution state.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)