Summary

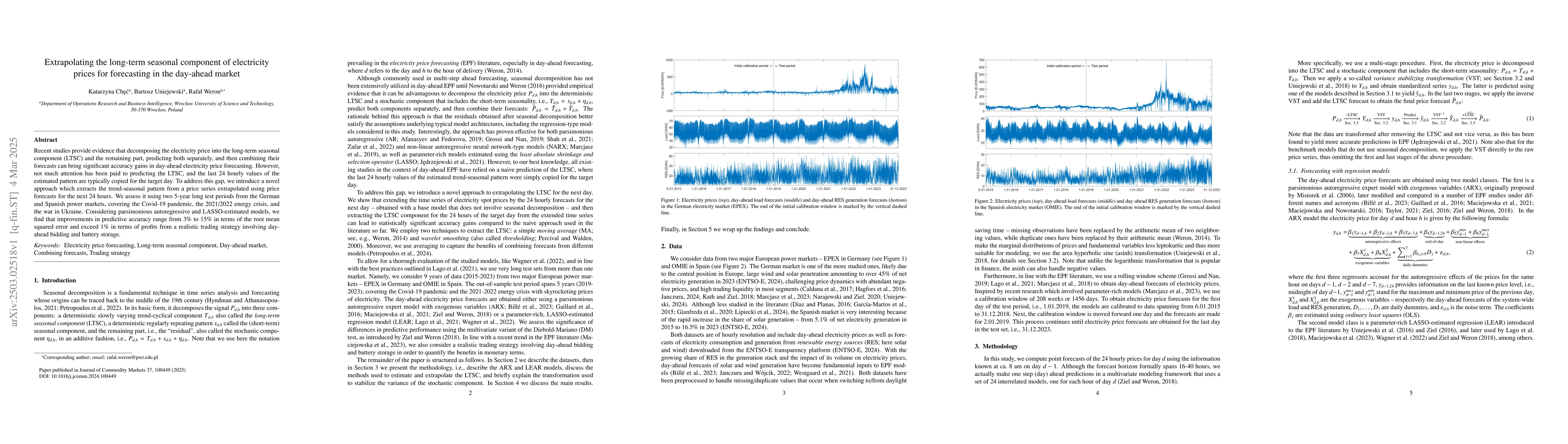

Recent studies provide evidence that decomposing the electricity price into the long-term seasonal component (LTSC) and the remaining part, predicting both separately, and then combining their forecasts can bring significant accuracy gains in day-ahead electricity price forecasting. However, not much attention has been paid to predicting the LTSC, and the last 24 hourly values of the estimated pattern are typically copied for the target day. To address this gap, we introduce a novel approach which extracts the trend-seasonal pattern from a price series extrapolated using price forecasts for the next 24 hours. We assess it using two 5-year long test periods from the German and Spanish power markets, covering the Covid-19 pandemic, the 2021/2022 energy crisis, and the war in Ukraine. Considering parsimonious autoregressive and LASSO-estimated models, we find that improvements in predictive accuracy range from 3\% to 15\% in terms of the root mean squared error and exceed 1\% in terms of profits from a realistic trading strategy involving day-ahead bidding and battery storage.

AI Key Findings

Generated Jun 10, 2025

Methodology

The research introduces a novel approach to predict the long-term seasonal component (LTSC) of electricity prices for the next day by extrapolating input price vectors before calculating the LTSC. It uses parsimonious autoregressive (ARX) and LASSO-estimated autoregressive (LEAR) models, comparing their performance with naive prediction methods.

Key Results

- Extrapolated LTSC-based models (eSCARX, eSCLEAR) significantly outperform naive LTSC counterparts (SCARX, SCLEAR) by a wide margin.

- Extrapolated LTSC-based models outperform corresponding benchmark models without seasonal decomposition.

- Moving average (MA) approach is confirmed to be a useful tool for identifying the LTSC.

- LEAR-based models consistently outperform ARX-based models, with reductions ranging from 2.89% to 15% in MAE and 3.29% to 8.49% in RMSE.

- The proposed method shows higher accuracy, especially for the German EPEX market, with improvements up to 15% in RMSE and 14% in MAE.

Significance

This research is important as it enhances day-ahead electricity price forecasting accuracy, which is crucial for market participants, regulators, and policymakers. Improved forecasts can lead to better risk management, more efficient market operations, and reduced costs for consumers.

Technical Contribution

The paper presents an innovative approach to predict the LTSC by extrapolating price forecasts, which improves the accuracy of day-ahead electricity price forecasting.

Novelty

This work stands out by focusing on the LTSC prediction and its extrapolation for improved day-ahead market forecasting, addressing the gap in existing literature that primarily uses the last 24 hourly values for the target day.

Limitations

- The study is limited to specific markets (German EPEX and Spanish OMIE) and may not generalize to other markets without further validation.

- The research does not explore the impact of other external factors, such as policy changes or technological advancements, on electricity price forecasting.

Future Work

- Further research could investigate the applicability of the proposed method to other energy markets and diverse datasets.

- Exploring the integration of additional factors (e.g., policy changes, technological advancements) into the forecasting models could improve their predictive power.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersForecasting day-ahead electricity prices in Europe: the importance of considering market integration

Probabilistic Forecasting of Day-Ahead Electricity Prices and their Volatility with LSTMs

Dirk Witthaut, Leonardo Rydin Gorjão, Benjamin Schäfer et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)