Summary

We propose a specification test for conditional location--scale models based on extremal dependence properties of the standardized residuals. We do so comparing the left-over serial extremal dependence -- as measured by the pre-asymptotic tail copula -- with that arising under serial independence at different lags. Our main theoretical results show that the proposed Portmanteau-type test statistics have nuisance parameter-free asymptotic limits. The test statistics are easy to compute, as they only depend on the standardized residuals, and critical values are likewise easily obtained from the limiting distributions. This contrasts with extant tests (based, e.g., on autocorrelations of squared residuals), where test statistics depend on the parameter estimator of the model and critical values may need to be bootstrapped. We show that our test performs well in simulations. An empirical application to S&P 500 constituents illustrates that our test can uncover violations of residual serial independence that are not picked up by standard autocorrelation-based specification tests, yet are relevant when the model is used for, e.g., risk forecasting.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

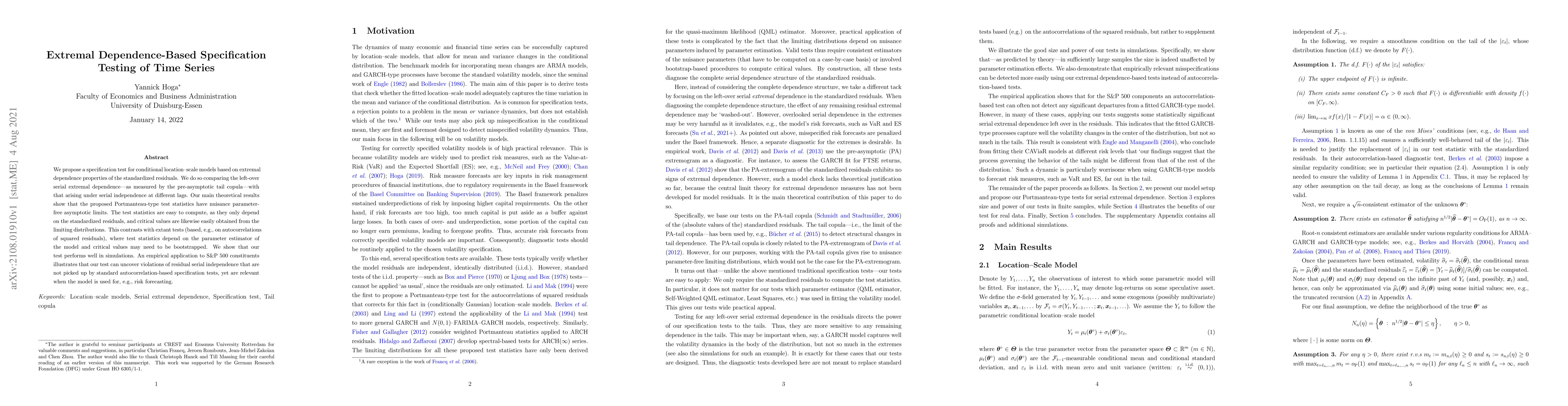

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)