Summary

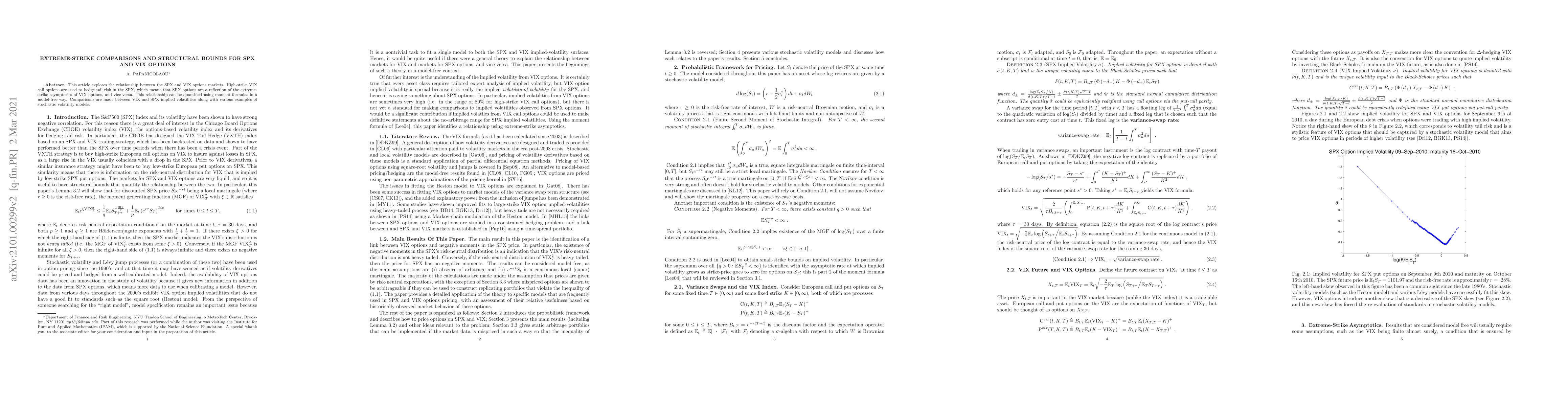

This article explores the relationship between the SPX and VIX options markets. High-strike VIX call options are used to hedge tail risk in the SPX, which means that SPX options are a reflection of the extreme-strike asymptotics of VIX options, and vice versa. This relationship can be quantified using moment formulas in a model-free way. Comparisons are made between VIX and SPX implied volatilities along with various examples of stochastic volatility models.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRough multifactor volatility for SPX and VIX options

Antoine Jacquier, Aitor Muguruza, Alexandre Pannier

Joint calibration to SPX and VIX options with signature-based models

Guido Gazzani, Christa Cuchiero, Sara Svaluto-Ferro et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)