Summary

We consider a stochastic volatility model where the dynamics of the volatility are described by linear functions of the (time extended) signature of a primary underlying process, which is supposed to be some multidimensional continuous semimartingale. Under the additional assumption that this primary process is of polynomial type, we obtain closed form expressions for the VIX squared, exploiting the fact that the truncated signature of a polynomial process is again a polynomial process. Adding to such a primary process the Brownian motion driving the stock price, allows then to express both the log-price and the VIX squared as linear functions of the signature of the corresponding augmented process. This feature can then be efficiently used for pricing and calibration purposes. Indeed, as the signature samples can be easily precomputed, the calibration task can be split into an offline sampling and a standard optimization. For both the SPX and VIX options we obtain highly accurate calibration results, showing that this model class allows to solve the joint calibration problem without adding jumps or rough volatility.

AI Key Findings

Generated Sep 03, 2025

Methodology

The paper proposes a stochastic volatility model using linear functions of the signature of a primary multidimensional continuous semimartingale. It derives closed-form expressions for VIX squared by exploiting the polynomial nature of the truncated signature.

Key Results

- The model allows for joint calibration of SPX and VIX options without adding jumps or rough volatility.

- Closed-form expressions for VIX squared are obtained by leveraging the polynomial property of the truncated signature of a polynomial process.

- Highly accurate calibration results are demonstrated for both SPX and VIX options.

Significance

This research provides a novel approach to modeling and calibrating volatility surfaces, which is crucial for pricing and risk management in financial markets.

Technical Contribution

The paper introduces a signature-based model for joint calibration of SPX and VIX options, utilizing the properties of the signature to derive closed-form expressions for VIX squared.

Novelty

The approach of using signature-based models for calibration, combined with the linear representation of VIX squared, distinguishes this work from previous methods that often rely on more complex stochastic processes or numerical approximations.

Limitations

- The model assumes the primary process to be of polynomial type, which may not capture all market dynamics.

- The calibration process requires precomputing signature samples, which could be computationally intensive for high-dimensional processes.

Future Work

- Investigate the applicability of the method to other financial instruments and market conditions.

- Explore methods to reduce computational complexity for higher-dimensional processes.

Paper Details

PDF Preview

Key Terms

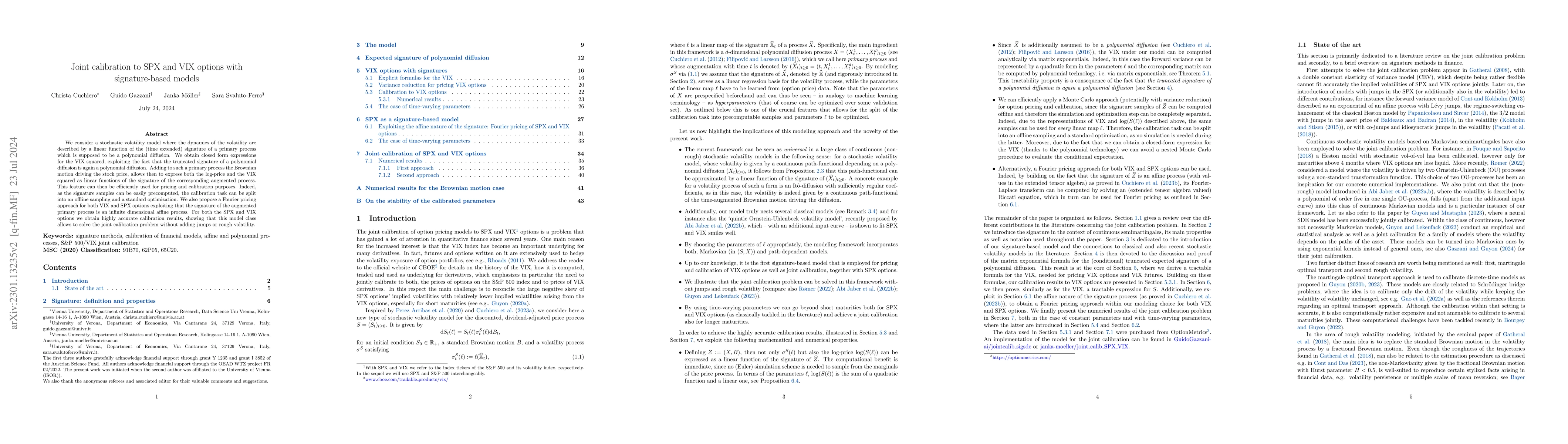

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRough multifactor volatility for SPX and VIX options

Antoine Jacquier, Aitor Muguruza, Alexandre Pannier

Joint SPX-VIX calibration with Gaussian polynomial volatility models: deep pricing with quantization hints

Li, Eduardo Abi Jaber, Shaun et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)