Authors

Summary

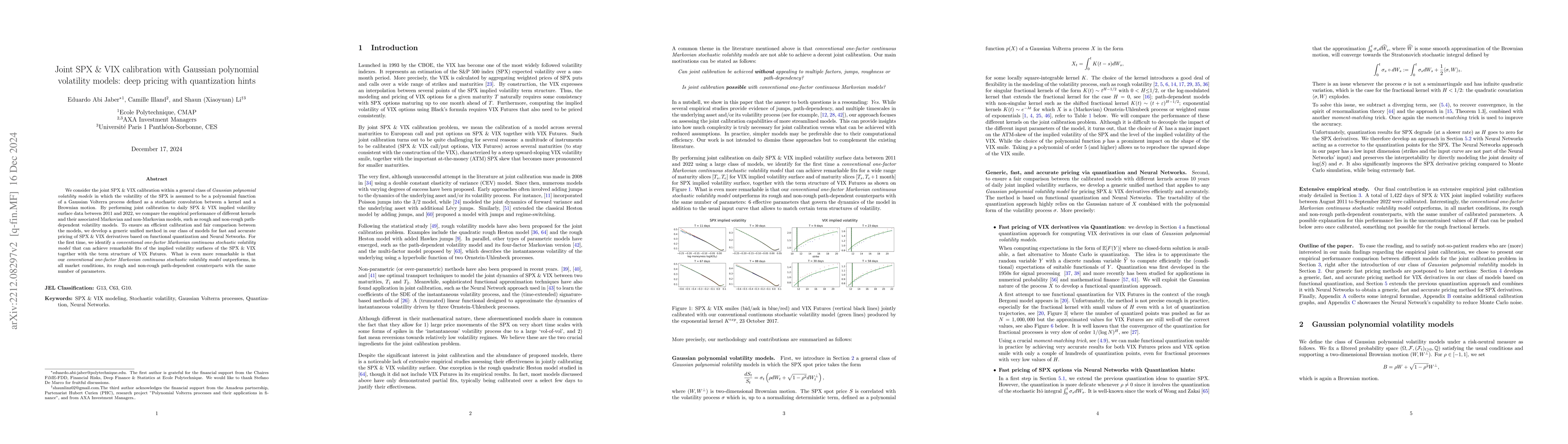

We consider the joint SPX-VIX calibration within a general class of Gaussian polynomial volatility models in which the volatility of the SPX is assumed to be a polynomial function of a Gaussian Volterra process defined as a stochastic convolution between a kernel and a Brownian motion. By performing joint calibration to daily SPX-VIX implied volatility surface data between 2012 and 2022, we compare the empirical performance of different kernels and their associated Markovian and non-Markovian models, such as rough and non-rough path-dependent volatility models. In order to ensure an efficient calibration and a fair comparison between the models, we develop a generic unified method in our class of models for fast and accurate pricing of SPX and VIX derivatives based on functional quantization and Neural Networks. For the first time, we identify a \textit{conventional one-factor Markovian continuous stochastic volatility model} that is able to achieve remarkable fits of the implied volatility surfaces of the SPX and VIX together with the term structure of VIX futures. What is even more remarkable is that our conventional one-factor Markovian continuous stochastic volatility model outperforms, in all market conditions, its rough and non-rough path-dependent counterparts with the same number of parameters.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersJoint calibration to SPX and VIX options with signature-based models

Guido Gazzani, Christa Cuchiero, Sara Svaluto-Ferro et al.

The quintic Ornstein-Uhlenbeck volatility model that jointly calibrates SPX & VIX smiles

Li, Eduardo Abi Jaber, Shaun et al.

Rough multifactor volatility for SPX and VIX options

Antoine Jacquier, Aitor Muguruza, Alexandre Pannier

| Title | Authors | Year | Actions |

|---|

Comments (0)