Eduardo Abi Jaber

28 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Fourier-Laplace transforms in polynomial Ornstein-Uhlenbeck volatility models

We consider the Fourier-Laplace transforms of a broad class of polynomial Ornstein-Uhlenbeck (OU) volatility models, including the well-known Stein-Stein, Sch\"obel-Zhu, one-factor Bergomi, and the ...

Polynomial Volterra processes

We study the class of continuous polynomial Volterra processes, which we define as solutions to stochastic Volterra equations driven by a continuous semimartingale with affine drift and quadratic di...

Optimal Portfolio Choice with Cross-Impact Propagators

We consider a class of optimal portfolio choice problems in continuous time where the agent's transactions create both transient cross-impact driven by a matrix-valued Volterra propagator, as well a...

Signature volatility models: pricing and hedging with Fourier

We consider a stochastic volatility model where the dynamics of the volatility are given by a possibly infinite linear combination of the elements of the time extended signature of a Brownian motion...

Volatility models in practice: Rough, Path-dependent or Markovian?

An extensive empirical study of the class of Volterra Bergomi models using SPX options data between 2011 and 2022 reveals the following fact-check on two fundamental claims echoed in the rough volat...

Equilibrium in Functional Stochastic Games with Mean-Field Interaction

We consider a general class of finite-player stochastic games with mean-field interaction, in which the linear-quadratic cost functional includes linear operators acting on controls in $L^2$. We pro...

Reconciling rough volatility with jumps

We reconcile rough volatility models and jump models using a class of reversionary Heston models with fast mean reversions and large vol-of-vols. Starting from hyper-rough Heston models with a Hurst...

The quintic Ornstein-Uhlenbeck volatility model that jointly calibrates SPX & VIX smiles

The quintic Ornstein-Uhlenbeck volatility model is a stochastic volatility model where the volatility process is a polynomial function of degree five of a single Ornstein-Uhlenbeck process with fast...

Joint SPX-VIX calibration with Gaussian polynomial volatility models: deep pricing with quantization hints

We consider the joint SPX-VIX calibration within a general class of Gaussian polynomial volatility models in which the volatility of the SPX is assumed to be a polynomial function of a Gaussian Volt...

Optimal Liquidation with Signals: the General Propagator Case

We consider a class of optimal liquidation problems where the agent's transactions create transient price impact driven by a Volterra-type propagator along with temporary price impact. We formulate ...

Gaussian Agency problems with memory and Linear Contracts

Can a principal still offer optimal dynamic contracts that are linear in end-of-period outcomes when the agent controls a process that exhibits memory? We provide a positive answer by considering a ...

The characteristic function of Gaussian stochastic volatility models: an analytic expression

Stochastic volatility models based on Gaussian processes, like fractional Brownian motion, are able to reproduce important stylized facts of financial markets such as rich autocorrelation structures...

A weak solution theory for stochastic Volterra equations of convolution type

We obtain general weak existence and stability results for stochastic convolution equations with jumps under mild regularity assumptions, allowing for non-Lipschitz coefficients and singular kernels...

Trading with propagators and constraints: applications to optimal execution and battery storage

Motivated by optimal execution with stochastic signals, market impact and constraints in financial markets, and optimal storage management in commodity markets, we formulate and solve an optimal tradi...

Simulation of square-root processes made simple: applications to the Heston model

We introduce a simple, efficient and accurate nonnegative preserving numerical scheme for simulating the square-root process. The novel idea is to simulate the integrated square-root process first ins...

State spaces of multifactor approximations of nonnegative Volterra processes

We show that the state spaces of multifactor Markovian processes, coming from approximations of nonnegative Volterra processes, are given by explicit linear transformation of the nonnegative orthant. ...

Path-dependent processes from signatures

We provide explicit series expansions to certain stochastic path-dependent integral equations in terms of the path signature of the time augmented driving Brownian motion. Our framework encompasses a ...

Heath-Jarrow-Morton meet lifted Heston in energy markets for joint historical and implied calibration

In energy markets, joint historical and implied calibration is of paramount importance for practitioners yet notoriously challenging due to the need to align historical correlations of futures contrac...

Complex discontinuities of $\surd\overline{\text{Fredholm determinants}}$ in the Volterra Stein-Stein model

We study complex discontinuities arising from the miscomputation of the Fourier-Laplace transform in the Volterra Stein-Stein model, which involves the complex square root of a Fredholm determinant. D...

Fredholm Approach to Nonlinear Propagator Models

We formulate and solve an optimal trading problem with alpha signals, where transactions induce a nonlinear transient price impact described by a general propagator model, including power-law decay. U...

The Volterra Stein-Stein model with stochastic interest rates

We introduce the Volterra Stein-Stein model with stochastic interest rates, where both volatility and interest rates are driven by correlated Gaussian Volterra processes. This framework unifies variou...

Martingale property and moment explosions in signature volatility models

We study the martingale property and moment explosions of a signature volatility model, where the volatility process of the log-price is given by a linear form of the signature of a time-extended Brow...

Capturing Smile Dynamics with the Quintic Volatility Model: SPX, Skew-Stickiness Ratio and VIX

We introduce the two-factor Quintic Ornstein-Uhlenbeck model, where volatility is modeled as a polynomial of degree five based on the sum of two Ornstein-Uhlenbeck processes driven by the same Brownia...

From Hyper Roughness to Jumps as $H \to -1/2$

We investigate the weak limit of the hyper-rough square-root process as the Hurst index $H$ goes to $-1/2\,$. This limit corresponds to the fractional kernel $t^{H - 1 / 2}$ losing integrability. We e...

Simulating integrated Volterra square-root processes and Volterra Heston models via Inverse Gaussian

We introduce a novel simulation scheme, iVi (integrated Volterra implicit), for integrated Volterra square-root processes and Volterra Heston models based on the Inverse Gaussian distribution. The sch...

Weak solutions of Stochastic Volterra Equations in convex domains with general kernels

We establish new weak existence results for $d$-dimensional Stochastic Volterra Equations (SVEs) with continuous coefficients and possibly singular one-dimensional non-convolution kernels. These resul...

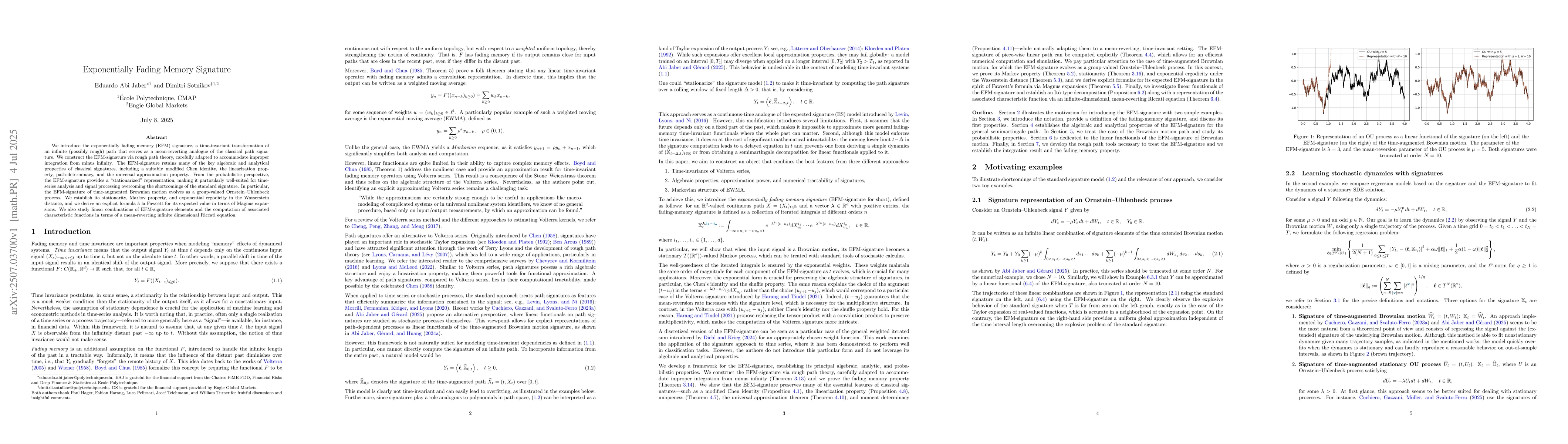

Exponentially Fading Memory Signature

We introduce the exponentially fading memory (EFM) signature, a time-invariant transformation of an infinite (possibly rough) path that serves as a mean-reverting analogue of the classical path signat...

Hedging with memory: shallow and deep learning with signatures

We investigate the use of path signatures in a machine learning context for hedging exotic derivatives under non-Markovian stochastic volatility models. In a deep learning setting, we use signatures a...