Authors

Summary

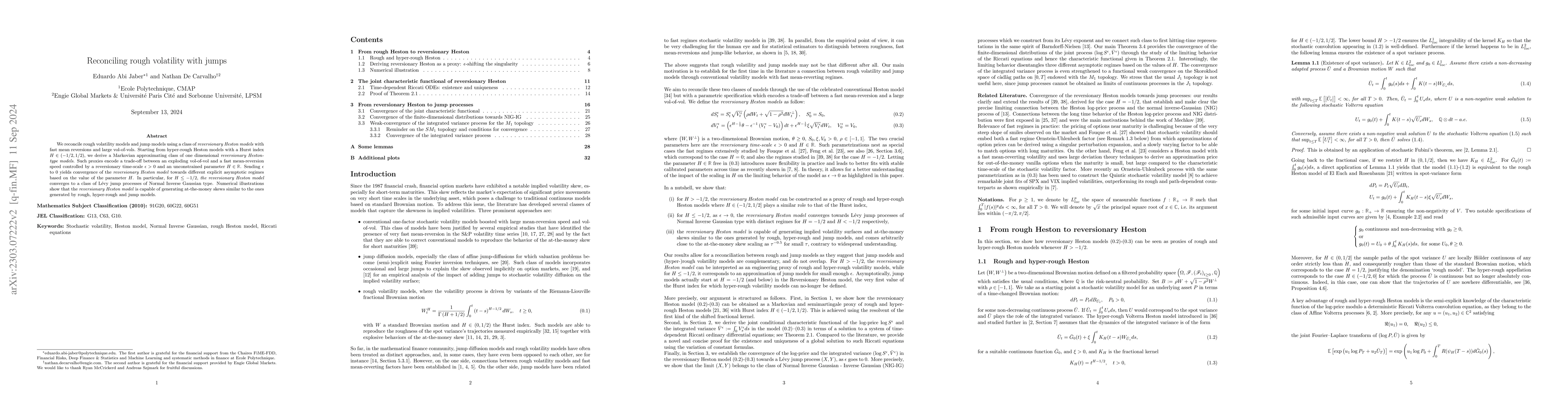

We reconcile rough volatility models and jump models using a class of reversionary Heston models with fast mean reversions and large vol-of-vols. Starting from hyper-rough Heston models with a Hurst index $H \in (-1/2,1/2)$, we derive a Markovian approximating class of one dimensional reversionary Heston-type models. Such proxies encode a trade-off between an exploding vol-of-vol and a fast mean-reversion speed controlled by a reversionary time-scale $\epsilon>0$ and an unconstrained parameter $H \in \mathbb R$. Sending $\epsilon$ to 0 yields convergence of the reversionary Heston model towards different explicit asymptotic regimes based on the value of the parameter H. In particular, for $H \leq -1/2$, the reversionary Heston model converges to a class of L\'evy jump processes of Normal Inverse Gaussian type. Numerical illustrations show that the reversionary Heston model is capable of generating at-the-money skews similar to the ones generated by rough, hyper-rough and jump models.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAn Efficient Calibration Framework for Volatility Derivatives under Rough Volatility with Jumps

Yuxuan Ouyang, Keyuan Wu, Tenghan Zhong

Local volatility under rough volatility

Peter K. Friz, Paolo Pigato, Stefano De Marco et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)